Tuesday, December 22, 2009

Podcast On The Present State Of The Spanish Economy

- How does what’s happened in Dubai affect the economic situation in Greece, Spain and the EU?

- Are left- or right-wing political parties causing or solving more problems during the recess...ion?

- Will the Germans, the French or the EU be able to bailout several European countries at the same time if there are several sovereign defaults?

- Are the ECB and the EU trying to pre-empt the IMF in Greece and Spain?

- What are the underlying structural problems with the eurozone funding plan?

- Why is the ECB channelling funds through monetary and financial institutions to buy up government debt in the eurozone?

- How the ECB is trying to use a carrot and stick approach with eurozone governments to control national government deficits and public policy?

- Is IMF intervention now inevitable in Greece?

- Will the ECB will try to play politics and pressure Zapatero in the run up to the 2012 general elections in Spain?

- Is the situation in Spain similar to the situation in Greece?

- Why don’t Zapatero and the Spanish government seem to be reacting?

- Why is there no coherent plan to get Spain back on its feet?

- What is going on with Spanish banks?

- Will unemployment in Spain reach 25% by the end of 2010?

- Which is more important in Spanish economics: image or hard data?

- Will it be possible for the Spanish government to reduce the deficit from over 10% of GDP to less than 3% by 2012 or 2013?

- What state will the Spanish economy be in by the end of 2010?

- What will happen to Spain when the ECB raises eurozone interest rates?

- Might Spain soon be in a worse economic position than Greece?

- What are the ratings agencies trying to achieve with their warnings on Spain?

- Why won’t the Spanish government tell the Spanish people the truth about what’s going on with the Spanish economy?

- Is José Luis Zapatero really the biggest problem for the Spanish economy right now?

Obviously many of these points run parallel to those raised in my recent post "Why Standard and Poor’s Are Right To Worry About Spanish Finances", but maybe, if you have 40 minutes or so to spare, you might enjoy listening to them being made in Podcast format.

Why Standard and Poor's Are Right To Worry About Spanish Finances

"Spain's weaknesses over the developing crisis reflect mainly the reversal of the continuous domestic demand expansion of over a decade, which was associated with high indebtedness of the private sector, large external deficits and debt, an oversized housing sector compared with the euro area average and fast rising asset prices, notably of real estate assets."According to Spanish Prime Minister José Luis Rodriguez Zapatero Spain's government is firmly committed to reducing its fiscal deficit, and is intent on lowering it as requested by the EU Commission by 1.5% of GDP annually, until it finally brings it within the EU 3 per cent of gross domestic product limit by 2013 at the latest. What's more he is quite explicit about how this is going to be possible: Spain is right now, and even as I write, on the verge of emerging from the long night of recession in whose grip it has been for the last several quarters. As such it will soon resume its old and normal path onwards down the highway of high speed growth. There is only one snag here: few external observers are prepared to share Mr Zapatero's optimism.

European Commission assessment of Spain's Response to the Excess Deficit Procedure, Brussels 11 November 2009.

“The latest services PMI data suggests that the Spanish economy remains on a downward trajectory. The fact that variables such as activity, new orders and employment all fell at sharper rates during November is real cause for concern, with the prospects for 2010 becoming increasingly gloomy. Businesses report that consumers remain cautious of making any major purchases, particularly those requiring credit. It appears that any economic recovery over the next twelve months will be gradual and drawn-out.”

Andrew Harker, economist at Markit commenting on the November Spanish Services PMI survey.

“The return to growth and the expected fiscal consolidation will allow us to reach the stability pact objectives by 2013,” Mr Zapatero said in a speech last week, using a rhetoric by which few outside Spain are now convinced, and indeed only the day before the credit rating agency Standard & Poor’s had revised its outlook for Kingdom of Spain sovereign debt to negative from stable. The decision followed their earlier move last January to downgrade Spanish debt by revising their long term rating from AAA to AA+. S&Ps justified their latest decision by stating that they now believe Spain will experience a more pronounced and persistent deterioration in its public finances and a more prolonged period of economic weakness versus its peers than looked probable at the start of the year. So things have been getting worse and not better, and indeed, the EU Commission themsleves seem to take a similar view, since while they have lifted their immediate excess deficit procedure in the short term (see below) their longer term worries have only grown.

Standard and Poor's feel that reducing Spain’s sizable fiscal and economic imbalances requires strong policy actions, actions which have yet to materialize, and the EU Commission and just about everyone else agree, and the only people who seem to take the view that the current policy mix is "just fine" are José Luis Zapatero, and the political party that maintains him in office.

Effectively S&P's are concerned about two things: i) growing fiscal deficits; and ii) growth prospects:

The change in the outlook stems from our expectation of significantly lower GDP growth and persistently high fiscal deficits relative to peers over the medium term, in the absence of more aggressive fiscal consolidation efforts and a stronger policy focus on enhancing medium-term growth prospects.Even some inside Spain are now openly questioning the viability of the government's strategy. The downward revisision in Spain's credit outlook, was "hard to deny," according to Spanish representative on the European Central Bank Governing Council, Jose Manuel Gonzalez-Paramo - "The ECB is not taking issue with whether Standard & Poor's should cut Spain's rating, but the report that accompanies this warning is hard to deny" he told the Spanish Press agancy EFE, adding that he was "convinced that the Spanish authorities share this analysis and will do whatever is needed to avoid S&P's negative outlook resulting in a change in rating". However Standard and Poor's explicitly justified the negative outlook by referring to the fact that Spain was not showing signs of taking adequate action to cut its longer term fiscal deficit as required by the EU Commission, and Spanish Prime Minister Jose Luis Rodriguez Zapatero himself stated he could see no no reason why ratings agency Standard & Poor's should downgrade the long-term sovereign debt rating of Spain. So it is hard to share Gomez-Paramo's (rather diplomatic) optimism at this point.

Compared to its rated peers, we believe that Spain faces a prolonged period of below-par economic performance, with trend GDP growth below 1% annually, due to high private sector indebtedness (177% of GDP in 2009) and an inflexible labor market. These factors, in turn, suggest to us that deflationary pressures could be more persistent in Spain than in most other Eurozone sovereigns, which we expect would further slow the pace of fiscal consolidation in the medium term.

The World Turned Inside Out

Just how realistic is the view being taking by the Spanish administration at this point, and just what are the prospects of that imminent and sutainable return to growth in the Spanish economy on which everything seems to depend? That is the question we will try to ask ourselves in that follows. Certainly the situation we are looking at is a rather peculiar one, since Mr Zapatero's recovery hope seems to be a widely shared one inside Spain. Certainly, if the ICO Consumer Confidence reading is anything to go by, Spaniards are feeling pretty hopeful at this point that the worst of the economic crisis is now behind them. Evidently confidence is still not back to its old pre-crisis level, but it is now well up from its July 2008 lows.

What is even more interesting is to look at the breakdown of some of the ICO consumer confidence index components. According to the ICO data series I looked at, the expectations index has only been above the present level three times since the series started in January 2004 (in September 2004, in January 2005, and in August 2009). That is, the Spanish people currently have the third highest level of expectations about the future registered at any point over the last five years. I find that pretty incredible. Evidently Mr Zapatero is not alone in assuming that S&P's have it wrong.

But is such a viewpoint rationally founded, and even more to the point, is there any economic justification which lies behind it? What could explain such dyed-in-the-wool optimism? It is hard to understand, unless, perhaps, the alternative - that Spain is in for a long and difficult economic correction, after many years of relatively "painless" economic growth - is very hard to contemplate for a population who are severely unaccustomed to such pressures.

Possibly the Financial Times' Victor Mallet puts his finger on another important ingredient - after two years of being told that they have been living though the worst crisis in recent memory, many Spaniards have quite simply never had it so good, so how could anything horrible possibly happen now?

The pre-Christmas mood in Madrid is a curious mixture of pessimism and cheeriness.On the one hand, anxious Spaniards are told they are suffering the worst economic crisis in 50 years and fear for their jobs. On the other, those still in employment have rarely had more money to spend. It is not surprising that the city’s restaurants are packed with noisy but neurotic diners as the holiday season approaches.

The reasons for this odd combination of economic gloom and robust personal consumption are no secret. Unemployment has risen sharply – to 18 per cent of the workforce in Spain – but emergency measures around the world to avert another depression have kept economies flush with liquidity and cut interest rates (and monthly mortgage payments) to historically low levels. Inflation is low or negative.

Low interest rates, safe jobs (or pensions) and salaries rising faster than the rate of inflation all combine to make "the worst" not that bad at all, especially if the government are shelling out 12% percent of GDP per annum to pay for it all. But as Javier Díaz-Giménez, economy professor at IESE business school says (and S&P's well know) “It is easy to raise the deficit to 10 per cent of GDP....But we really don’t know how to get back down to a deficit of 3 per cent of GDP.” This then is the problem, especially as a reducing deficit, rising taxes and utility charges, and eventually rising interest rates all make the task of restoring economic growth seem a rather daunting one.

Think about it this way: Spain's construction industry amounted to around 12 percent of GDP, now government borrowing of around the same size has stepped in to fill the gap, but once this poly-filla solution no longer holds, where is the employment creating activity to come from? As Michael Hennigan, Founder and Editor of Finfacts Ireland says in the (similar) Irish context:

"The scale of the task of creating sustainable jobs in the international tradable goods and services sectors, is illustrated... by stark statistics from State agency, Forfás, which show that in the ten years to 2008, less than 4,000 net new jobs were added by foreign and Irish-owned firms, while overall employment in construction, the public sector, retail and distribution, expanded by over half a million......Total Irish employment in December 1998 was 1.54 million and was 2.05 million in December 2008 - a surge of 33 per cent. In the peak boom year of 2006, 83,000 new jobs were added in the economy while direct job creation in the export sectors was less than 6,000."I don't have the comparable Spanish figures to hand, but the situation is surely not that different.

Meanwhile Spanish Industry and Services Show No Real Signs Of Recovery

There was no let up in the contraction in the Spanish manufacturing sector in November, and PMI data pointed to a further deterioration of operating conditions. Moreover, the rates of decline of key variables such as output, new orders and employment all accelerated during the month, with the seasonally adjusted Markit Purchasing Managers’ Index falling to 45.3, from 46.3 in October. The Spanish manufacturing PMI has now been below the neutral 50.0 mark for two years, with the latest reading being the lowest since last June.

Commenting on the Spanish Manufacturing PMI survey data, Andrew Harker,

economist at Markit, said:

“The Spanish manufacturing sector looks set to endure a bleak winter period, characterised by falling new business, job cuts and heavy price discounting. The glimpse of a possible recovery seen during the summer appears to have been only a temporary reprieve, with even the stabilisation of demand now seeming some way off again.”

The impression gained from the PMI data is broadly confirmed by the monthly output statistics supplied by the Spanish statistics office (INE) to Eurostat. True, in October the output index was up fractionally over September (a preliminary 0.29% on a seasonal and calendar adjusted basis), but there is no sign of any sort of recovery and the drift is still downwards.

Output has now fallen around 32% from its July 2007 peak.

Output has now fallen around 32% from its July 2007 peak.

Nor is the situation in the Spanish services sector much better, and November PMI data indicated that operating conditions among Spanish service providers worsened again during the month, and at a sharper pace than in the previous survey period. Business activity, new business and employment all fell more quickly than in October. The headline seasonally adjusted Business Activity Index – which is based on a single question asking respondents to report on the actual change in business activity at their companies compared to one month ago – dropped to 46.1 in November, from 47.7 in the previous month. The latest reading pointed to the fastest rate of decline since August.

The situation is also confirmed by the Spanish INE Services Activity Index, which shows that activity was down 7.9% in October over October 2008, following a 9.8% drop in October 2008 over October 2007.

Which means that activity was own a total of 17.4% from the July 2007 peak, or an average of 23% over the three months August - October, just better than the 25% average drop registered in January to March. Which means that while there is plenty of evidence that the contraction has stabilised during the last six months, this seems to be stability with a negative (and not a positive) outlook, given that things have now started to deteriorate again, and we must never forget that this stability has been achieved via a massive fiscal injection from the government, an injection which cannot be sustained indefinitely.

Construction Activity and House Prices Continue to Fall

Activity fell around one percent in October over September.

While total output is now down nearly 35 percent from the July 2006 peak. That is to say, this Christmas Spanish construction output will have been falling for nearly three and a half years, and this decline is going to be permanent, the only outsanding issue is what activity is going to replace it.

Spain's Employment Minister Celestino Corbacho was widely quoted in the Spanish press last week as saying that he could see clear signs that the housing market had "bottomed". I would really badly like to know where he is finding such signs.

In the first place Spain’s residential construction sector continues to shrink at an unprecedented rate. Housing starts fell by 47% (to 33,140) in Q3 compared to the same period in 2008, according to the latest figure from the Ministry of Housing. If we exclude social housing the fall was much greater - 61% less homes started in the period, and even 20% down compared to the second quarter.

At the other end of the production line the Housing Ministry reported 83,500 construction completions in the third quarter (excluding social housing), 41% down year on the same time last year and 13% down on the previous quarter. Over a 12 month period construction completions were down 35% to 444,544, and this in a market where sales of new properties are running at a rate of something like 200,000 properties a year. That is to say, the stock of unsold houses continues to swell.

And prices continue to fall, since even though the Tinsa property price index for November showed that average prices fell by only 6.6% over the previous 12 months (down from 7.4% last month - the smallest annual fall in a year) this piece of data is not that illuminating in a market where prices have now been falling for more than twelve months. So while TINSA's own annual price graphs make for a very encouraging looking trend line, you need to remember that they plot the percentage change in house prices on an annual basis. If we look at the overall index (below) we see pretty much the same picture as with everything else, slower decline, but decline nonetheless. No bottom hit yet.

And, of course, if we look at the peak to present chart, then the percentage fall simply continues, and house prices are now down 14.75% on the December 2007 peak.

And it isn't only sceptics like me who think there is still a long, long way to go with Spain's house price adjustment. According to the latest report on the housing market by BBVA, Spanish property prices were 30% over-valued at the end of 2007, since they only fell by something like 10% in 2008, they have another 20% or so to drop before the correction is over. BBVA thus expect prices to fall by 7% in 2009, 8% next year, and 5% in 2011 Prices won’t stabilise until 2012, and the price correction is likely to be a protracted and long drawn out affair. What the likely impact of this on the real economy, and on their balance sheet, is likely to be they don't say.

BBVA mentions another key reason why the fall in Spanish house prices is far from over - the high ratio of house prices to annual disposable income. This ratio (house prices / annual disposable income) rose to 7.7 years at the height of the boom, and has now fallen back to 6.6 years. But that is a long way off the historical average of 4, not to mention the 3.5 it has fallen to in the US.

Meanwhile, a new report from BNP Paribas Real Estate, the real estate arm of French bank BNP Paribas, argues that banks in Spain (currently the largest holders of unwanted real estate) will need to start offering bigger discounts (of up to 50% in 2010 they suggest) if they are to really start to move their stock of property. Spain's banks claim to be offering discounts to buyers, but as BNP Paribas Real Estate argue, judging by the growing inventory they hold, these are not big enough to attract the volume of sales they really need.

In fact, after several months of dithering towards a recovery the Spanish housing market fnally relapsed again in October, with the number of houses falling by 24% compared to the same month last year, according to the latest figures from the National Institute of Statistics (INE).

In fact sales in October fell below the 30,000 transactions per month rate for the first time since last April. Sales were down by 10% over September. According to Mark Stucklin of Spanish Property Insight the explanation for this relapse is to be found in the breakdown between new build and resales. During the first half of 2009 sales of newly built homes were significantly higher than resales, whereas in normal years it’s the other way around. Indeed, if new build sales hadn’t been higher this year the market crash would have been significantly worse. But many of the new build sales recorded this year were actually sold off plan during the boom, and many others were banks buying properties from developers to keep them afloat, so not they were not really sales at all. Naturally, as those sources of sales start to dry up (either as the stock of sold off plan evaporates, or banks cannot accept too many more), then new build sales begin to head south.

As you can see from the above chart which Mark produced for his post, new build sales dropped sharply in October, almost to the level of resales. And if we look at the rate of monthly house sales in the P2P chart below, you will see that monthly sales have now dropped by neary 60% from their peak. That is to say, we are still having something over 400,000 new houses coming off the production line, and only a maximum of 200,000 new home purchases. Even as output drops towards an annual 100,000, this level of sales would only clear off the backlog at a rate of something like 100,000 a year, which mean we would be well over a decade clearing off that massive backlog, and meantime who foots the bill for maintaining such a large stock?

The chart above tells the story eloquently. It shows cumulative sales over 12 months to the end of every quarter, and you can see how the market has shrunk from just above 1 million sales over the 12 months to the end of Q1 2006, to just above 400,000 sales at the end of Q3 this year. In terms of transactions, the market has shrunk by around 60% over that period.

And we get a similar picture on the mortgages front, with the volume of new residential mortgages signed in September being 62,411, down 4.2% compared to the same month last year. In value terms the fall was more pronounced, with new residential mortgages dropping 16% to 7.3 billion Euros. The good news is the annual decline in new mortgage lending has been bottoming out in the last few months. It fell 31% in June, 19% in July, 7% in August, and 4.% in September.

And looking towards the future again, the number of new homes started in the third quarter was down 54% compared to the same period in 2008, according to the latest figures from Spain’s College of Architects. Excluding social housing, there were just 17,500 planning approvals in the third quarter, compared to 28,400 last year. To put this into perspective, planning approvals were down by 94% from the 287,000 granted in the third quarter of 2006, at the height of Spain’s construction boom. The chart (below, and which comes again from Mark Stucklin) shows just how dramatically Spain’s residential construction production chain has collapsed in the last few years. This year there are likely to be a total of just over 100,000 planning approvals, the lowest level in more than 20 years.

Unemployment Rising Towards the 20 Percent Mark and Beyond

Spain's registered jobless total rose for the fourth consecutive month in November according to data from the employment office INEM, and is obviously bound to rise further as the recession drags on and the multi-billion euro stimulus package gradually loses steam. Seasonally unadjusted data showed Spanish jobless claims rose by 60,593 in November from October to reach a total of almost 3.9 million people, almost a million more than a year ago.

The rise was milder than the almost 100,000 layoffs in October and leap of around 170,000 seen in November 2008, but this should not be taken as a sign the economy will begin to create jobs any time soon. Data showed the jobless rate in the service industry rose 1.7 percent month-on-month and by 1.3 percent in construction. Joblessness also increased by 0.6 percent in the industrial sector and by 2.6 percent in agriculture.

The Spanish government has injected some 8 billion euros (nearly one percent of GDP) into the economy this year in order to create more than 400,000 mostly low-skilled jobs in order to put a temporary patch on the hole left by the paralysed housing sector. The 30,000 or so infrastructure contracts created under what is know as plan E will be completed by the end of the year, and with little sign of a general return to growth, or a revival in job creating activity the majority of those employed on these projects will surely soon be finding their way back onto the dole queues. The government has announced plans for a new 5 billion euro stimulus plan for 2010, but this, in theory, will be aimed at sustainable long-term growth sectors like renewable energy, environmental tourism and new technologies.

November's 1.5% rise in jobless claims is nonetheless weaker than the 2.6 percent rise in October, the 2.2 percent in September and the 2.4 percent in August. And the annual rate of increase fell sharply, from 42.7% in October to 29.43% in November. But does the month mark a new trend, or will we see renewed deterioration as the winter advances? The Spanish administration officially provides only quarterly (unadjusted) data on the unemployment rate but does forward a monthly (and seasonally adjusted) rate to according to the European Union statistics agency Eurostat, based on the Labour Force Survey (which is generally regarded as a more accurate (and internationally comparable) assessment of the true level of unemployment than simple Labour Office signings. This stood at 19.3 percent in October, the second highest rate in the entire EU, and behind only Latvia.

Of course, as ever with this administration, hope springs eternal. The Spanish economy will likely return to growth early next year and start creating new jobs toward the end of next year, according to Finance Minister Elena Salgado: "I think there is a high probability we will start to grow in early 2010," she told the Cadena Ser radio station, although she did admit that the trend of rising unemployment will not likely be broken until late 2010 or early 2011. "We think we will start to see net job creation in some sectors at the end of 2010, and more clearly in 2011," she said. This realism about job creation is, of course, a by-product of the very low 2010 growth rate envisaged by even the optimistic forecast of the Spanish government (less than one percent), which given the need for drastic productivity improvement in Spain would evidently not be enough to create new employment. And, of course, others are less optimistic, with both the EU Commission and the IMF foreseeing negative growth in 2010. Indeed the EU Commission still anticipates unemployment to be over 20 percent in 2011.

Basically the outlook is bleak, and unemployment is far more likely to continue rising than it is to fall. My own current estimate (which in part depends on how much consumer prices fall, on how seriously the government follows the agreed 1.5% reduction in the fiscal debt, and on how rapidly interest rate expectations rise at the ECB) is that we should be moving towards the 25% range around next summer.

Domestic Consumption Continues To Decline

Despite the best efforts of the Spanish government stimulus programme household consumption continues to decline, at a slower rate in the third quarter, but still decline. The quarter on quarter drop was 0.1% as compared with a 1.5% drop in the second quarter, and a 2.4% fall in the first one. On an annual basic household consumption was down 4.2% in the third quarter following a 7.5% drop in the second one (see chart).

And retail sales simply keep falling, more slowly than before, but down and down they go. In October they fell back again over September, and were down a total of 10.3% from their November 2007 peak.

In October they fell back again over September, and were down a total of 10.3% from their November 2007 peak.

So Why Should We Expect Recovery In 2010?

Or better put, why should we suspect that we might not see a Spanish economic recovery in 2010? Well, let's take a quick look at some of the structural features of Spanish GDP. As the Spanish administration never lose an opportunity to point out, Spain's economic contraction to date has been significantly less extreme than both the Eurozone 16 and the EU 27 averages. GDP never actually declined as dramatically as it did in some other countries.

But looking at the situation in this way is rather misleading, since in fact, as can be seen in the chart below (which comes from the Spanish statistical office - the INE - as does the chart above) in fact domestic demand in the Spanish economy fell every bit as rapidly as in other European countries, but this was offset by changes in the external balance which moved in such a way as to add percentage points to the final GDP reading.

On analysing the two main components of Spanish GDP from the expenditure side in in the third quarter, the INE found, on the one hand, that national demand reduced its negative contribution to annual GDP movements by nine tenths as compared with the previous quarter, from minus 7.4 to minus 6.5 points, whereas conversely, the external balance reduced its positive contribution to aggregate growth by seven points, from 3.2 to 2.5 percentage points. Now all of this is, as I say, rather strange to those unaccustomed to the niceties of GDP analysis, since the positive contribution from external trade to GDP growth has got nothing to do with extra exports, but rather it is a product of the fact that Spain was running a whopping trade deficit, and simply reducing this trade deficit gave the positive impetus to GDP, whereas the third quarter negative impact of external trade was the product of, guess what, a further deterioration in the trade balance as imports once more started to rise more rapidly than exports (see chart below). It is this dynamic - of yet another deterioration in the trade balance as the ression slows and as the government pumps demand into the economy - which raises concerns about long term economic stability, since obviously no susbtantial recovery in competitiveness has taken place.

Now all of this is, as I say, rather strange to those unaccustomed to the niceties of GDP analysis, since the positive contribution from external trade to GDP growth has got nothing to do with extra exports, but rather it is a product of the fact that Spain was running a whopping trade deficit, and simply reducing this trade deficit gave the positive impetus to GDP, whereas the third quarter negative impact of external trade was the product of, guess what, a further deterioration in the trade balance as imports once more started to rise more rapidly than exports (see chart below). It is this dynamic - of yet another deterioration in the trade balance as the ression slows and as the government pumps demand into the economy - which raises concerns about long term economic stability, since obviously no susbtantial recovery in competitiveness has taken place.

The thing is, behind this whole situation there lies the problem of debt, and indebtedness. Basically, despite the fact that many, many Spaniards have never had it so good as they did in 2009, Spanish living standards have actually been falling since the amount of money available for current spending has been falling. What we need to take into account here is the sum of actual earned income PLUS what Spanish citizens are able to borrow during any given time period. Essentially when you borrow you shift disposable income from one time period to another. This is why Franco Mogigliani advanced what has come to be called the life cycle theory of saving and borrowing, since patterns change across the age groups, and naturally as whole populations age the pattern of any particular country changes. A younger country - Ireland, the US - is much more likely to be a net borrower, while an older country - Japan, Sweden, Germany - is much more likely to be a net saver.

So why is all this important. Well, during the years you borrow, you spend more. I think this is obvious, and this is also why when there are less capital inflows there are less imports. Capital flows are to finance borrowing, and borrowing improves living standards in the short term, until it has to be paid back. Remember the saying, "I am a rich man till the day I have to pay my debts". Spain was rich in this sense, as José Luis Zapatero never ceased to remind its citizens. But Spain's citizens were rich based on very heavy borrowing levels - households owed about 100% of GDP, and corporates around 120% - borrowing which had been used to inflate land, house and commercial property values to well beyond their true market equivalents, and hence these "riches" were in fact very unreal.

The impact of the sort of capital flows Spain was receiving is that in the short term your disposable income goes up (someone gives you money to spend), while later on it goes down (as you have to subtract from earned income to pay back). This latter situation is where Spain is now. The capital flows have been sustained in the short term via the ECB liquidity process, which has fuelled domestic demand via government borrowing and spending, but at some point all of this needs to be reversed and the debts need to be paid down, and that will mean lower disposable income (in terms of money to spend) for the internal population as a whole, which is why without sales abroad domestic consumption will only continue to fall and unemployment will continue to rise. The only way to compensate for this is to export and run a trade surplus, since in this way the debt payments can be made without subtracting from current income. Indeed, as we can see from the chart below, despite the fact that households and corporates have now started deleveraging, total Spanish indebtedness (as a % of GDP) continues to rise, thanks in part to the growing indebtedness of the state (which is, in the end, a liability for all Spain's citizens), and in part to the fact that GDP is itself contracting. This is Keynes paradox of thrift at work if ever there was a case, since the more Spanish savings rise, the more indebted Spain becomes. And now, as the fiscal stimulus is withdrawn, if GDP falls faster, then the position may well not improve, especially if prices fall and Spain enters a deflationary spiral.

Of course, borrowing is not income neutral in the longer term either, since it all depends what the borrowed funds are spent on. If you spend the borrowed money on infrastructure, education and new productive capacity (ie useful investment) then evidently you can raise the trajectory of GDP in the longer term, while if you only use it to finance short term consumption - or invest in a lot of houses no one really needs - then you simply get a destruction of internal productive capacity, massive price distortions and long term GDP on a lower trajectory. This is where Spain, Greece and much of Eastern Europe are now.

Basically, for those countries who lack their own currencies there is now real alternative to a rather painful “internal devaluation” to restore export competitiveness and the trade surplus. And this of course is why everyone from Standard and Poor's to the EU Commission and the ECB are now insisting not only on a return to fiscal order, but deep structural reforms to restore competitiveness.

EU Excessive Deficit Procedure Now The Key

On 27 April 2009 the European Council (Ecofin, the Finance Ministers of member states basically) decided, in accordance with Article 104(6) of the Treaty establishing the European Community, that an excessive deficit existed in Spain and issued recommendations to correct the excessive deficit by 2012 at the latest. At the time this appeared to imply an average annual fiscal reduction of 1.25 % of GDP would be required over the period 2010-2013. The Council also established a deadline of 27 October 2009 for effective action to be taken.

According to the Commission January 2009 interim forecast, Spain's GDP was projected to decline in by 2 % in 2009 and by a further 0.2 % in 2010. However, Spain's economic outlook deteriorated rapidly during the course of 2009 and the Commission autumn forecast projected a GDP decline of 3.7 % in 2009 and a further decline of 0.8 % in 2010 (basically the same as the IMF October outlook). As the Commission stress, the downward revision in nominal (current price) terms has been even stronger, since prices (and the GDP deflator) have been falling over the period, and this is a strong negative factor for both revenue and outstanding debt to GDP levels.

Spain’s fiscal outlook also worsened in the course of 2009 reflecting this sharper-than-expected fall in economic activity. Notably, the Commission autumn forecast project the 2009 general government deficit to come in at 11.2 % of GDP, compared with the 6.2 % deficit envisioned in the January forecast. In particular, revenue has fallen sharply more than expected, as the result of the stronger-than-assumed fall in activity and of the fact that tax proceeds are reflecting falling activity much more strongly than the normal long-term tax elasticity considerations would have suggested.

Thus in the Commission review of the Spanish Excess Deficit Procedure carried out at the end of October, they found that the plans for government expenditure foreseen in the January 2009 update of the Spanish stability programme had been broadly observed (and this is the big difference with the Greek case) although the expenditure-to-GDP ratio increased on account of the lower-than-expected nominal GDP level.

The Commission now expect the 2009 deterioration in the fiscal outlook to continue into 2010, although the discretionary fiscal measures adopted by the Spanish government post January 2009 were considered to have played no role in the intervening deterioration in the fiscal outlook. They thus took the view that "unexpected adverse economic events with major unfavourable consequences for government finances" had occurred and thus recommended a provisional lifting of the Excess Deficit Procedure, conditional on substantial further progress in bringing the deficit within the 3% of GDP limit by 2013.

Looking ahead to 2010, the Commission took the view that the draft 2010 Budget Law published in late September 2009, which targeted a general government deficit of 8.1 % of GDP in 2010. was credible, given that the combined impact of the withdrawal of the temporary stimulus measures, on the one hand, and of the new discretionary measures presented in the draft 2010 Budget Law, on the other, could yield a significant improvement of the fiscal balance by some 1.75 % of GDP in 2010. Further in the light of the unanticipated deterioration in Spanish government finances an average annual fiscal effort in excess of that originally recommended - at least 1.25 % of GDP - is needed between 2010 and 2013 in order to bring the headline government deficit below the 3 % of GDP reference value by 2013. The Commission aregue that this correction would represent an average annual fiscal effort of above 1.5 % of GDP over the period 2010-2013.

The Commission autumn forecast, projects a government deficit of 11.2 % of GDP in 2009 and 10.1 % of GDP in 2010. Assuming unchanged policies, and GDP growth of 1 % in 2011, the deficit would then be 9.8 % of GDP. A credible and sustained adjustment path thus requires the Spanish authorities to implement the budgetary plans outlined in the draft 2010 Budget Law; ensure an average annual fiscal effort of above 1.5 % of GDP over the period 2010-2013; and, most importantly, to specify the measures that are necessary to achieve the correction of the excessive deficit by 2013.

As the Spanish administration constantly point out, Spain's accumulated national debt is a lot lower as a percentage of GDP than that of many other EU member states, and even after 2011 will remain below the EU average. However, as given the difficult situation likely to be faced by Spanish banks and the heavier than average weight of ageing in Spain, the burden of Spain's finances in the context of an economy which may struggle to find growth over the next decade should not be underestimated.

According to the Commission autumn forecast, general government debt is projected to reach 54.3 % of GDP in 2009, up from 39.7 % in 2008. Although it is currently still below the 60 % of GDP EU reference value, debt is expected to increase further in 2010 and 2011 to 66 % and 74 % of GDP respectively. And evidently there is strong downside risk here should growth be lower than anticipated, and/or prices fall, this number could rise significantly, and it could should Spain's banks need a substantial bailout at some point.

As the Commission point out, the long-term budgetary impact of ageing in Spain is well above the EU average - mainly as the result of a projected high increase in pension expenditure as a share of GDP over the coming decades. The budgetary position in 2009 compounds the budgetary impact of population ageing on the sustainability gap. The Commission thus stresses the importance of improving the primary balance over the medium term and of further reforms to Spain's old-age pension and health-care systems in order to reduce the risk to the long-term sustainability of public finances.

Indeed, the Council of Finance Ministers (Ecofin) specifically "invited" the Spanish authorities to improve the long-term sustainability of public finances by implementing further old-age pension and health care reform measures when they lifted the Excess Deficit Procedure at the start of December. The Council also invited the Spanish authorities to implement reforms with a view to raising potential GDP growth.

As Standard and Poor's stressed, their decision to revise the Spanish sovereign outlook to negative reflected the perceived risk of a further downgrade within the next two years in the absence of more aggressive actions by the authorities to tackle fiscal and external imbalances. It is the continuing silence which surrounds this absence which is so ominous, and makes the concerns of the EU Commission and the various ratings agencies at this point more than understandable.

Saturday, December 12, 2009

The Velocity Of Modern Financial Crises

As Ralph Atkins pointed out, the Greek government is but the latest to learn that in the modern world you can be catapulted from relative obscurity to global prominence in a matter of hours. Everyone can be famous for five minutes, as Andy Warhol said, but this kind of fame most of us could well live without.

Faced with the assessment by Ratings Agency Standard and Poor's that Spain's economic and financial situation was deteriorating, the Spanish Prime Minister Jose Luis Rodriguez Zapatero simply limited himself to an outright rejection of such negative economic forecasts, declaring the naysayers to be wrong in the light of the -to him - self-evident fact that Spain was just about, at this very moment, to emerge from the recession which has now bedevilled it for so many months. Indeed he even went as far as to say they were wrong, since he he could find no reason why Standard & Poor's should downgrade Spain's long-term sovereign debt rating, "From our perspective there are no reasons for it, firstly because of the strength of the country (and) because the public accounts are solvent," he told the Onda Cero radio station. Standard and Poor's in fact argued that "The downgrade ... reflects our expectations that public finances will suffer in tandem with the expected decline in Spain's growth prospects", a viewpoint with which few external observers would disagree.

Indeed, Spain's representative on the ECB governing council Jose Manuel Gonzalez-Paramo told the Spanish press agency EFE, in an interview widely quoted in Spanish media, that he, himself, found the S&P opinion hard to disagree with: "The ECB is not taking issue with whether Standard & Poor's should cut Spain's rating, but the report that accompanies this warning is hard to deny....I'm convinced that Spanish authorities share this analysis and will do whatever is needed to avoid S&P's negative outlook resulting in a change in rating," he said.

Had Mr Zapatero found it within his repertoire to be able to express similar sentiments I am sure he would have done more to convince the world at large that he is aware of the problem, and is willing to take the necessary action. As it is, he simply leaves the impression that what just happened in Greece will eventually and inevitably happen in Spain, with all the suddenness and lightning-strike velocity M Trichet was warning about. What we seem to be facing is what Gabriel Garcia Marquez once called the Chronicle of a Death Foretold.

So what do the rest of us do, simply sit back and watch that "accident waiting to happen" actually happen? Angela Merkel may have other thoughts, since speaking in Bonn last Thursday she indicated that she, at least, was of the opinion pressure could be brought to bear on the national parliaments of countries with looming budgetary difficulties.

"If, for example, there are problems with the Stability and Growth Pact in one country and it can only be solved by having social reforms carried out in this country, then of course the question arises, what influence does Europe have on national parliaments to see to it that Europe is not stopped.....This is going to be a very difficult task because of course national parliaments certainly don't wish to be told what to do. We must be aware of such problems in the next few years."

Well, if such pressure can be brought it most certainly now should be. And not over the next few years, but rather, if M Trichet is to be believed, during the coming weeks and months. Lightning may well not strike twice in the same place, but it most certainly can strike twice.

A New Version of the Weak Euro Meme

Well, having been so lavishing in my praise of Ralph Atkins in recent posts, perhaps it is time for the administration of a gentle "rapapolvo" (otherwise, you know Ralph, people might start to talk), and just to hand he offers me the ideal opportunity to "discrepar". A little instability is, it appears, a dangerous thing, but not, it seems entirely and unequivocally dangerous:

True, Greece’s plight has weakened the euro, which has ended this week back down at levels last seen in early November. A weaker euro, however, will help boost eurozone growth - and thus come as a relief to eurozone policymakers. A little instability is not necessarily all bad.

Now, with all the other pressing topics I currently have on my plate I would normally have quietly passed this one by, had it not been for the fact that earlier in the week, over at the Economist, they came up with a similar "saving grace" for a partial Greek default.

How badly the euro’s standing would be hurt by a default would depend on the state of public finances elsewhere: if America were struggling too, the dollar might not seem an attractive bolthole. If the current struggles with a strong euro are any guide, euro members might even half welcome a tarnished currency.

I can think of a thousand and one different ways in which the euro might lose some of its current strong value, I can even imagine a goodly number of those which might be decidedly positive, but what I can't for the life of me accept is that one of them would be the sort of economic, financial and political chaos which we may now be about to see in Greece.

Thursday, December 10, 2009

That Which The ECB Hath Separated, Let No Man Join Together Again!

One of the subtleties of yesterday’s complex package from the European Central Bank was that it attempted to re-assert the principle of “separation”. When the financial storm broke in August 2007, the ECB insisted, doggedly, that emergency financial market liquidity injections were not related to its monetary policy. That remained firmly aimed at controlling inflation and still very much determined the level at which it set the main policy interest rate. Indeed, in July last year the ECB famously raised the interest rate to 4.25 per cent because inflation appeared to be getting out of control.

The separation that is being talked about here is not then a matrimonial one, nor is it a Montesquieu type notion of a necessary and sufficient separation of powers between Brussels and Frankfurt, rather what is involved is a separation, which is customarily made by the ECB, between monetary policy and liquidity provision. Now all of this may seem rather obscure, and it is, but it is also, I will argue here, rather central to understanding what the ECB is up to, or trying hard to be up to, at the present moment in time, and why what it seems to be giving with one hand it also seems to be taking away with the other.

For over a month now the ECB has been busily trying to lay down, before an ever observant corps of financial journalists, the main lines of its exit strategy from the emergency liquidity provisions introduced in the midst of the financial crisis. The first significant decision was the raising of the collateral standards for asset backed securities - from March 1 2010 the bank “will require at least two ratings from an accepted external credit assessment institution for all” asset- backed securities submitted as collateral, according to the press release of 20 November.

It is important to note that, at this point in time, the ruling only applies to asset backed securities, and the ECB has yet to formally confirm that the temporary relaxation of the collateral criteria as applied to government bonds for the duration of the financial crisis will be withdrawn as planned at the end of 2010. This, of course, has become far more than an academic question following this weeks decision by Fitch Ratings to cut the ranking of Greek sovereign debt to BBB+. What this means, effectively, is that should the two other major ratings follow suit (a not improbable scenario) then the ECB will no longer be able to accept Greek bonds as collateral, since while the ECB is currently accepting bonds with a minimum BBB- rating, this gesture is surely going to be phased out as the enhanced liquidity support is withdrawn . As things stand, as of 2011 at least one A- will be the minimum level required.

More significantly for many perhaps, this month’s ECB meeting also saw the ECB move to scale back its emergency lending to the banking sector in a way that clears the path for a move back to variable rate tenders later in the year and leaves policy makers free to raise rates as needed. The bank announced that this months 12-month tender would be the last and indicated that the 6-month tenders would also be axed after 31 March. The 12-month tender would also be offered at what amounts to a floating rate that would be indexed to future changes in the ECB’s main refinancing rate in a way which means it is impossible to discern in advance any particular intention about the level of the main refinancing rate. At the same time they indicated that the weekly, 1 month and 3 month financing tenders would remain in place on a fixed interest rate full allotment basis for as long as necessary, and at least until April 13, which means that while enhanced bank financing is being slowly phased out, it is still in place, and there is no definitive date yet for the complete termination of the programme.

Basically this all seems fairly logical, and yet, as Ralph Atkins asks, one obvious question remains, which is why the it should be the case that the ECB is so intent on implementing its “exit strategy” when, surely, given the seriousness of the problems which are still to be resolved in some key Eurozone economies, one might have thought they should continue to implement some sort of ultra-loose monetary policy just like their counterparts in the Bank of Japan, the US Federal Reserve, or the Bank of England?

Well, part of the key to unravelling the apparent dilemma the recent move presents is possibly to be found in a response ECB President Jean-Claude Trichet gave in answer to questions put to him by journalists after the last meeting. “We are not" he was at pains to say "signalling anything in terms of a hardening of our monetary policy - absolutely nothing,” So here we have it, as Frank Atkins suggests, the ECB is applying a straight principle of separation between monetary policy and liquidity provision (although I doubt that many financial journalists are quite as perceptive as Frank Atkins evidently is). Monetary policy remains as loose as it ever was, with the key refinancing rate staying firmly at the 1% level (hardly suprising in the context of the fragility of most Eurozone economies) while the enhanced liquidity provision is being systematically withdrawn. Now why should this be?

Greek Abuses

Well, one of the principal problems the ECB currently faces is the use which is being made of all that ever so generous enhanced liquidity ECB funding by Greek banks. According to analysts at Goldman Sachs Greek banks have been making very extensive use of the ECB liquidity provision. They estimate that at the end of the third quarter of this year, the four major Greek banks (Alpha, Eurobank, National Bank of Greece, and Piraeus) had availed themselves of some €28.3 billion in liquidity provision, down admittedly from the €42.3 billion they were soaking up at the end of the second quarter, but still way over the percentage of Greek participation in ECB capital. And even this reduction comes, it should be remembered, aftered the Central Bank of Greece directed local lenders to scale back their reliance on cheap funding from the European Central Bank.

Yet, as Goldman Sachs point out, such extensive use of the ECB exceptional liquidity provision might seem rather counterintuitive given that the loan to deposit ratio within the Greek banking system is pretty low (between 98% and 122% for the four major banks) and the liquidity position of the banks thus appears very sound. So why the hell do they need so much money you may ask?

Well, using ECB facilities made sense for Greek banks for a number of reasons. In the first place, ECB funding is relatively cheaper for Greek banks than for their European peers since the ECB makes no adjustment to the rates charged for the perceived higher risk of the Greek banks. As Goldman Sachs point out a Greek bank operating in Greece pays the same price as a French bank in France, even though the French bank operates in a lower risk environment and should, in theory, be able to finance at lower rates in the market. But this is what enhanced liquidity support is all about, if only those responsible for the financial and economic administration of Greece understood the situation.

Secondly, the current spreads on Greek government bonds (around 200 base points over German 10 year equivalents) offer Greek banks an exceptional arbitrage opportunity, since by taking advantage of the uniform ECB liquidity rate Greek banks can buy higher Greek government bonds with a much higher yield than the government bonds which their French or German counterparts buy. Regardless of the risk implied through by the Greek CDS spread, Greek government bonds carry a zero risk weighting when calculating riskweighted assets for capital purposes. So for Greek banks this arbitrage carries no capital impact whatsoever. That is to say the Greek banks have been doing very nicely indeed out of the Greek sovereign embarassment, than you very much. Hence it is not difficult to understand the ECB's growing sense of outrage with the situation.

On top of this we need to add the growing frustration of the ECB and EU Commission on finding that the Greek government not only had not taken advantage of these liquidity advantages to introduce effective policy action to stop the deterioration of Greek government finances, but in fact had gone in precisely the opposite direction, greatly exceeding in spending decisions all their earlier promises and guarantess. Finance Minister Papaconstantinou's final 2010 budget plan, as presented to parliament on November 20, made plain that the financial situation is much worse than anticpated, and that the government now aims to reduce the fiscal deficit from 12.7% of GDP this year to 9.1% of GDP next year. In the earlier draft, as made available to the EU Commission when it determined that Greece had taken insufficient action in 2009, the objective was 9.4% of GDP for this year. The Commission calculates that under unchanged policies, the Greek deficit would be 12.2% of GDP in 2010 with government debt at around 120.8% of GDP, up from 113.4% this year.

So to be absolutely clear, the Greek banks have been making money from arbitrage on ECB exceptional liquidity funding and in the proces financing the Greek government to carry out spending programmes while at the same time basically hoodwinking the European Commission about what it was they were actually up to. That is to say, the ECB has been effectively paying to lead the EU Commission straight down the garden path.

And In Spain Things Aren't Much Different

According to Bank of Spain data, Spanish banks were receiving approximately 82 billion euros in longer term financing from the ECB as of last September.

And, as in Greece, a large chunk of this money has been being immediately recycled to finance a ballooning government deficit, one which, as in Greece, is expected to hit 12% of GDP this year.

So the ECB has been providing, indirectly, funding to Spain's government in a bid to help Spain try to withstand the hefty economic crisis it is faced with, and this government spending (along with the significant drop in interest and loan payments produced by the 1% interest rate which impacts Spanish loans and mortgages) has given strong support to Spanish domestic demand. But after years of structural distortion, Spain's manufacturing sector is, let us remember, massively uncompetitive.

In fact, Spain's manufacturing sector was contracting in November at the fastest rate in any of the 26 countries included in the JP Morgan Global Manufacturing PMI survey.

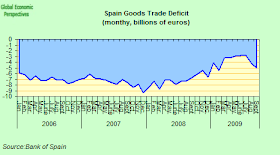

And where, then,could we imagine that all this money which is being used to prop up demand has gone? Well, we could imagine couldn't we. On buying imports, that's where a big chunk of it has gone, even as Spain's unemployment queues grow longer and longer. After falling for several months, September's goods trade deficit was up again, and has in fact it has been rising since last August. So let's spell this out again - Spanish banks wer receiving a total of 82.5 billion euros in liquidity funding via your open market operations in September, up from 49.1 billion euros in September 2008, and this money, far from having a positive impact, has been going to sustain the unsustainable.

At the same time, Banco de España data show that over the same time period Spanish bank funding of government borrowing rose from around 300 billion euros to around 400 billion euros, while the monthly goods trade deficit increased from 2 billion euros to 5 billion euros between July and September 2009, and the September current account deficit bounced back to a rate of roughly 4.5% of GDP from the July low of around 2% (see chart below). So where, we might ask oursleves is the "correction" here? This kind of monetary and fiscal support on the part of the ECB is entirely justified and understandable, if it is really to give a cushion to countries like Spain and Greece to make a painful transition. But if the money is simply used to sustain the unsustainable, and even is used to make the situation worse, then what really is the ECB supposed to do?

It must be worrying ECB decision makers like hell that the enhanced liquidity provision which is being facilitated from the ECB is, in the context of the very low level of international competitiveness of a good part of Spanish industry and services following the distortions produced by the property bubble, having the rather perverse and completely unintended consequence of funding a rise in Spanish imports (thus putting ever more Spaniards in the domestic sector out of work) via the demand injection which is being administered by the Spanish government?

Monsieur Trichet Is Not Amused

Exactly these sort of concerns were put directly to Monsieur Trichet in his quarterly appearance before the Economic and Monetary Affairs Committe of the European Parliament last Monday by the Catalan MEP (and member of Convergencia Democràtica de Catalunya ) Ramon Tremosa. Here is is question:

Monsieur Trichet, there are countries in the Eurozone that are starting to recover and some others, like Spain, in which the absence of reforms will condemn them to remain in recession for the coming months.

In France, for instance, household lending and house purchases are now growing, while in Spain lending to households continues to decrease, and the housing market remains flat and lifeless. Therefore,

1.- Are you worried by such apparent diversity within the Eurozone?

2.- In your opinion, what practical implications such divergence will have for the conduct of monetary policy at the ECB?

Under a "European divergence" scenario, it could happen that the "Optimum Currency Area" assumptions wouldn´t be valid anymore, and that an "average" monetary policy would start being harmful instead.

For example, if some European countries (like Germany or France) start having positive inflation rates, while others (like Spain, Greece, Portugal or Ireland) continue in deflation, implementing an "average" monetary policy could be harmful: especially if the monetary policy, due to the high weight of the French and German economies, leads to the "average" monetary policy becoming slightly restrictive. This would lead to further rounds of deflation in the "deflationary" countries.

3.- Has the ECB a plan to cope specifically with this issue? Or will the ECB continue with the "average" monetary policy it has exercised until now?

Monsieur Trichet was not amused. In a strongly worded reply that was given extensive coverage in the Spanish press (but barely received a mention in the English language one), he told Ramon Tremosa in no uncertain terms that there would be no second chance for the banks, "There is not one Euro for Spain, and another for the other countries. There is only one Euro, one rate of interest, and one exchange rate".

So, the carving knives are now out. The ECB has been put in an impossible position, and intends to act as it sees fit. The lions share of the responsibility now rests on the shoulders of Europe's political leaders. Only this afternoon Angela Merkel came to the temporary rescue of an increasingly besieged Greece, by pointing out that healthier members of the euro zone aren't prepared to abandon Greece and other heavily indebted countries in the currency union. Worthy remarks, and absolutely to the point. But how far is it the responsibility of richer and economically healthy states to continually come to the rescue of those who insist on doing nothing to improve their own situation? On precisely the same day Spanish Prime Minister Jose Luis Rodriguez Zapatero came out fighting, and rejected all rejected negative economic forecasts that currently surround Spain, saying for the umpteenth time that Spain was about to emerge from recession. How much more in denial is it possible to be, and how much longer must the future of all Europeans continue to be put at risk by head in the sand statements like this?

It's All Greek To Me

To add even more theatricality to the "drama" groups of protestors predictably battled it out with police on Athen's streets, in marches that were ostensibly to commenorate the death of a young teenager in last years riots. Even the normally staid and prudent Economist throws its weight in behind the charge with a piece whose title tells it all: "Default Lines" (perhaps the words "in the sand" could have been thrown in to add a bit more tension), which goes so far as to suggest that a partial Greek default might even be welcomed by some Eurozone member states, since it might take some of the heat off a hard pressed euro.

As if to add a little more spice to the story, Standard and Poor's decided to pick this Monday to announce it was putting Greece's A- long-term sovereign credit rating on Credit Watch with negative implications, with the unusual little "extra" that it gave the Greek government only 60 days, as opposed to the customary 90, to respond with adequate information to avoid the decision of downgrading to BBB+ (a level which if it was generalised across the rating agencies would imply that Greek Bonds would no longer be eligible as collateral at the ECB once the temporary relaxation of normal criteria which accompanies the extraordinary liqidity measures is withdrawn - although who really knows when this is likely to be). Naturally bondholders were not slow in reacting to the news and the spread on the 10-year Greek/German bond yield widened again, to 201 basis points from the 174 basis points level of late last Friday.

Actually, this is far from the first time that investors and journalists have been getting excited about the default risk on Greek public debt. In fact that very same Spiegel had an article headlined Greece Teeters on the Brink of Bankruptcy as far back as last April (that's a hell of a lot of "teetering" that has been going on), while the ever interesting Willem Buiter had a lengthy and influential blog post back in January on the worthy topic of whether or not it was structurally possible for a member state to default on its sovereign debt and remain in the eurozone (his conclusion was that it was, and in fact I don't disagree with him).

But gentlemen are we not getting rather ahead of ourselves. As I said at the start, in the long run Greek Sovereign debt may be dead than the deadest of ducks, but it ain't dead yet, nor is it likely to be in the most immediate future, there is far too much at stake for all of us for this to simply be allowed to happen, "sin mas". In fact it was the much more cautious Moody's who made the relevant points here in a press release issued last Wednesday where it argued forcefully that investors' fears that the Greek government may be exposed to a liquidity crisis in the short term are totally misplaced.

Now words here do matter, Moody's are completely right, the Greek government will not be exposed to a liquidity crisis in the short term (as opposed to a sabre rattling threat of one from the ECB among others), but this does not mean that they do not face a solvency issue in the longer term. That is, in the longer term I am absolutely sure that Greek public finances are deader than that proverbial dodo, the thing is, the long run simply hasn't arrived yet.

Let Moody's talk, since they do talk sense in this case:

"the risk that the Greek government cannot roll over its existing debt or finance its deficit over the next few years is not materially different from that faced by several other euro area member states".

So here's the first point, the Greek situation is a bad one, but it is not "materially different" from that of a number of other eurozone member states (I will return to this) even if the risk of its losing sovereign bond collateral eligibility is greater than that of any other member state, at this point. In the second place what Greece is inevitably facing is not a liquidity crisis (I'm sorry Maria, no financial crisis at this point), but a long term solvency one if it can't raise its trend growth rate in the context of the looming cost of maintaining an ever larger dependent population with a declining and ageing workforce. That is to say, the strategic problem for Greek public finance is not the quantity of debt accumulated to date, but rather the impending dead weight of future liabilities, and how these can be met. In this case, short term technical default to wipe the slate partially clean and start-up again would resolve nothing, since without a much higher underlying growth rate (without the aid of government deficit funding) the impending liabilites are not supportable, and decision takers at Ecofin and the ECB know this perfectly well, which is why they may well rattle the sabres, but in the short term at least we will see little in the way of exemplary action. For a sovereign default in Greece (a mature developed economy) would be a complete first, and would take us all into very new, and uncertain territory, since it could quite literally become a default from which there was no viable route for return.

So What Is The ECB Up To?

The FT's Frank Atkins has confessed to having been struck by the comments on Greece made by Jean-Claude Trichet, European Central Bank president, at the press conference which followed last weeks ECB rate setting meeting. I am sure he was not the only one who was listening, and given food for thought.

When asked about the country’s acute fiscal difficulties and the risk of a possible default, M Trichet simply stated he had every "confidence that the government of Greece will take the appropriate decisions”. This remark, as Frank Atkins says, was notable for its lack of forecfulness and could suggest he does not entirely rule out Greece facing sufficient problems servicing its debt that it might be forced into the hands of an external agency like the International Monetary Fund.

Indeed M Trichet's statement could be interpreted as meaning that an exasperated ECB would almost welcome such an eventuality, and might by withdrawing easy short term funding from Greek Banks even give things a hefty shove in the direction of just such an outcome. But an ECB which does not frown on the possibility of their most recalcitrant pupil being steered briskly towards the welcoming arms of the IMF is not the same thing as an ECB which envisaging, contemplating, or even in its wildest dreams vaguely imagining a Greek sovereign default. Any suchbdefault would surely follow, and not precede a (flawed and failed) IMF intervention, or would be the inevitable by prooduct of Greece being unceremoniously ejected from the Eurozone by sheer market forces, with the ECB relegated to meer spectator, unable despite its best efforts to contain the situation.

So my reading of the situation as it stands now, is that policymakers will do all that is in the power (which is a lot) to avoid the markets having so much say in the matter, but that what they do want to do is keep up the pressure on the new Socialist administration in Athens. Their aim is surely to try to turn back the “moral hazard” screw whereby European Union authorities, in giving the impression that they will always and ever ride to the rescue, no matter what the provocation (and Greek statistical authorities sure have been doing some provoking), simply encourage member state governments to continue to act recklessly. And this becomes all the more important given the fact, as I mentioned earlier, that Greece is only one among several problem pupils, and that more than the credibility of the Greek government (of which surely there is little left), what is being tested is the credibility of the European Union's institutional structure.

We might be forgiven for getting the impression that to date rather than acting as a stimulus to deep economic reform, Euro membership has rather acted to reward those countries who would get into more and more debt, with ever less sustainable economic models, by supplying them with funding at far cheaper rates of interest than the markets would otherwise make available. It is this particular clockhand that Europe's leaders would now dearly like to turn backwards, and this is why I have little doubt that it is in Greece that a stand will now be taken. If not, then that longest of long runs may arrive rather sooner than some of us, at least, are comfortable with.