The Kindom of Spain was not amused, and struck back in their London roadshow (courtesy of Elena Salgado and Manuel Campa) with their own version of the same issue.

Spain, we are informed is not so badly off, since Italy's position is much worse. Even more to the point, adding 3 million or so unskilled workers to the dole queues, and closing down a large chunk of Spain's core construction industry (driving the unemployment rate up to 19.5% in the process) has been extremely beneficial, since cleaning out all those low productivity, unskilled workers has meant that the productive power of the rest looks a lot better (since average productivity of those in work has risen). But isn't this just where the fiscal deficit issue comes in? These workers are still being supported by the rest via the Spanish system of employment benefits, so the productivity improvement (as far as Spain as a whole is concerned) is simply an optical illusion.

This is a point that Krugman could have picked up on but didn't, although he did follow through with a further post full of very revealing charts. The core issue here is that the problem Spain faces, as Paul stresses, is not essentially a fiscal one, a point which may be clearly seen in the following comparison of German and Spanish fiscal deficits over the last decade.

As he shows, Spain had no fiscal problem till the housing boom went bust. No of course, the need to prop up the economy, and support all the "unproductive" labour which doesn't show up in the unit labour costs chart is producing a massive fiscal deficit. Thus the fiscal issue in Spain is a symptom, not a cause. The root of the problem lies in the structural distortions produced by the massive overheating of the economy during the boom years, an overheating which lead to excessive inflation, large-scale dependence on imports, and a complete loss of competitiveness in the non-tradeable sector - a loss of competitiveness which even the Kingdom of Spain accept.The problem with the Spanish argument is that it seems to neglect the rather inconvenient fact that those workers who are deployed in the tradeable sector also eat bread and go to hairdressers and ride in taxis and buy or rent homes just like everyone else. So they themselves need to pay prices set in the non-tradeable sector, and their salaries have to reflect this. Hence a problem in non-tradeables becomes a much more general one. And it shows up, naturally enough, in the current account balance.

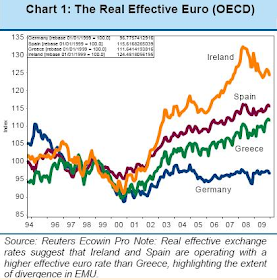

Of course, just as there is more than one way to peel an onion, there are a variety of different ways to measure competitiveness (GDP deflator, unit labour costs, etc). My own favourite back-of-the-envelope measure is what is known as the Real Effective Exchange Rate (REER, which shows at roughly what sort of virtual rate the Peseta would trading with the Deutsche-mark (were the two still to exist, of course).

Smokin' Gun

Indeed, analysts at PNB Paribas recently took the REER argument one step further, and showed how, far from addressing the competitiveness issues in Greece and Spain the recent bout of fiscal spending was in fact making the situation worse.

This is a point I have been trying to make in a number of recent posts by using two simple charts. The ECB eased liquidity in the Spanish banking system last June with a massive injection of one year funding.

This money went, via bank purchases of Spanish Treasury Bonds, to fund the government deficit, leading to a large injection of demand into the real economy. But what happened to that demand? Just look at the chart below. The trade deficit started to widen again, as Spaniards availed themselves of their additional spending power to buy yet more foreign products.

So essentially the issues is this one. Spain's economy will not recover, and return to growth till Spanish products become more attractive in price terms, and this only means one thing: some sort of internal devaluation is inevitable, and all the talk about an exclusively fiscal correction is simply an attempt to get rid of the smoke without going to the trouble of extinguishing the fire which is producing it.

In the page 10 of "Salgado's roadshow" document (http://economics.sas.upenn.edu/~jesusfv/tesoro.pdf) appears two interesting charts showing than share in world exports from Spain hadn't declined during the past years (also service exports have increased).

ReplyDelete¿Why if Spanish competitiveness has decreased, exports didn't?

Edward et all,

ReplyDeleteThe proof that the need of an internal devaluation is far form accepted is the fast an unexpected agreement between CEOE and the trade unions for a three-year long wage fixation "master agreement".

Without a miraculous recovery from abroad, this year deficit will exceed the 10% of PIB, worsening the market outlook for Spain. Spain will end up sailing the same waters than Greece, sooner or later. Troubled times ahead.

JH

In http://www.fedeablogs.net/economia/?p=2671 Jesús Fernández-Villaverde, Dr. in economics, discuss a lot of charts, and have a less pessimistic opinion abut Spanish economy.

ReplyDeleteParticularly interesting are the last two charts than show Spanish share in world exports had not reflected loss of competitive.

Hello fcasarra,

ReplyDelete¿Why if Spanish competitiveness has decreased, exports didn't?

Yep I've seen these charts, personally I think they are very misleading, but I will deal with them in my next Expansion blog post but one, since I think this kind of argument only goes on inside Spain.

Basically, if this argument were solid, why would there be such a large trade and current account deficit. Think about it, something doesn't add up here. If Spain were so competitive, like China, Japan and Germany we would have a trade surplus. Comparing Spain with Italy is also silly, since Italy has near zero trend growth, and if Spain follows that path we will never get below 20% unemployment, and the banks and the government will go bust due to all the indebtedness that needs to be serviced.

What I think is that people are treating this as some kind of football match where national pride is at stake. What is more interesting here is not to advance silly arguments, but to get an accurate analysis, and take remedial action to put things straight.

Simply staying in denial leads nowhere, or rather it does lead somewhere, to national bankruptcy, but personally I'd rather avoid that.

Spain's share in world trade (both exports and imports) rose in the early 2000's as a result of increasing openness in the EU, but Spain was taking more imports than it was selling exports, and that is the problem people need to deal with.

Jesús Fernández-Villaverde doesn't seem to mention the external debt mountain problem, or how to start paying it down.

Actually looking through the Fernández-Villaverde article again it seems to me to be more and more crazy. It seems to talk about every aspect of trade, except the DEFICIT.

ReplyDeleteAlso, look at this:

Pero esto, en buena parte, vino porque en España estábamos poniendo a trabajar a gente que anteriormente no trabajaba o inmigrantes en sectores de baja productividad, lo que hizo bajar la productividad media. Dejadme que ponga un ejemplo. Imaginémonos un país con tres personas: un ingeniero y dos camareros. En el periodo 1, trabaja un ingeniero y un camarero mientras que el segundo camarero está en paro. En el periodo 2, el segundo camarero encuentra trabajo. ¿Qué pasa con la productividad media? Que baja....

The only conclusion here is that since there are more people with the educational level of waiters in Spain than with the educational level of engineers, then living standards have to be lower, since you can't possibly compete with people with a higher educational level.

Of course, you need to change this in the longer term, by having a better educated population, but here the shape of the population pyramid works against you.

But like I say, this doesn't seem to be living in the real world, since what we have is a burst construction bubble on our hands, and a couple of million displaced building labourers out of work. We can't simply keep paying them to stay at home. Work commensurate with their skills and education has to be created, and it needs to be created in the tradeables sector so we can start to pay down the debt. These are the constraints we work under, and these are the problems which need solutions.

Incidentally, one further point occurs to me: why do they only mention the Spanish share in global exports? This one stinks to me personally. Consider this:

ReplyDeletei) Global imports = global exports (by definition, trade is zero sum)

ii) Spain's trade deficit deteriorated over the period 2000 to 2009 - that is imports grew more than exports.

iii) thus logically Spain's import share grew more than it's export share in world trade. That is Spain became a growing force in world IMPORTS.

Why does no one from the Kingdom of Spain mention this? How does this reflect the competitiveness of the Spanish economy. Why should Spaniards prefer foreign products to those "made in Spain"?

Total silence.

Basically, if people are serious about trying to find solutions to these pressing and urgent problems they should try being intellectually honest, address the real issues, and stop confusing people with scientific sounding but essentially irrelevant waffle.