Well, it's been more time than I care to remember since I posted anything on this site. In the interim many things have happened, especially on the European sovereign debt front. I think I now have plenty of stuff lined up to waffle about, but maybe one simple way to ease myself back in to the world of blogging would be to republish the lengthy interview I just gave to the website Barcelona International Network. The topics covered range from the debt crisis itself, to prospects for Spain under the new Partido Popular government of Mariano Rajoy, and to the kinds of tensions with might arise in the months and years to come between Catalonia and the rest of Spain, and, of course, how this relationship might itself in turn have an impact on the debt crisis itself.

Barcelona International Network: There seems to be some chaos and confusion surrounding the future of the euro and the sustainability of a cohesive eurozone at the moment. Can you briefly summarise the background to the present crisis?

Edward Hugh: You are right. The situation is far from clear. To understand what is happening now it is important to understand the evolution of this crisis from the beginning. Europe's monetary union was founded on the idea that with time the various economies which make up the Euro Area would ultimately converge towards one common prototype. This unfortunately has not happened, indeed what we saw during the first decade of this century was quite the contrary: the divergence of the constituent economies. Thus, while it is common to talk of "core" and "periphery" it is important to understand that the so called core economies are not identical, while those on the periphery do not all suffer from the same ailment. In Greece the problem has been excessive (and indeed almost fraudulent) deficit spending. In Italy the problem is accumulated government debt - debt which has been amassed during two decades now. In Spain and Ireland the problem is the bursting of a housing bubble, a bubble which was made possible by the application of an excessively loose monetary policy by the ECB. In Portugal the problem has been one of very low economic growth. etc, etc. So if there is not one common illness it is hard to apply one common cure.

In many ways it is unfortunate that the Greek crisis was the first one to break out, since this has reinforced earlier stereotypes that the problem with the Euro is the lack of sufficiently strong fiscal controls from the centre. This is surely the case, but it is only part of the problem, and far too much of Europe's leaders time and energy has been devoted to this issue, to the neglect of many others which in many ways have equal or even greater importance. What is true is that lying at the heart of the present crisis (across developed countries, that is including Japan, the UK, the US etc) is the issue of debt, whether this be public sector debt or private debt. That is why what we have is called a sovereign debt crisis.

In addition, another of the characteristic features that make this crisis historically unique is that it is occurring in the midst of an unprecedented process of population ageing in economically developed societies, with rapidly rising elderly dependency ratios - hence the importance given to the sustainability of health and pension spending into the future. It is not only accumulated debt that worries investors, but implicit liabilities, and how these are going to be met.

Thus the crisis of the Euro Area is only the most extreme form of a debt crisis which engulfs almost all developed societies. And the situation is only further exacerbated by the fact that the deleveraging of debt which is now required (and hence the likely low growth levels) have as a backdrop a surge in growth in many emerging economies which makes these an attractive candidate for investment from those who worry about the sustainability of debt in the mature economies. So the relative risk evaluation between developed and emerging economies is changing, and this process is unlikely to go into reverse gear. Developed society debt is unlikely to ever be so cheap to finance and so easy to sell as it was during the first decade of this century.

Barcelona International Network: What do you see as the three most likely future scenarios for the euro from this point, in order of increasing probablility?

Edward Hugh: As I have suggested, the Euro Area crisis is similar to that in other developed countries, but worse due to the institutional deficits with which the monetary union was created. In particular attention has focused on two areas, the role of the central bank (the ECB) and the lack of a common fiscal treasury. To some extent these deficiencies are now being remedied, but the pace of adaptation is slow, and the financial markets are starting to lose patience. Alarm signals have been going off over the last week, not only due to the surge in the yields on Spanish and Italian debt but also due to evidence that the infection (contagion) is now spreading to what was previously considered to be the core (France, Austria) with the evident danger that more countries will lose their triple A rating. Should this materialise it will make some earlier strategies for financing Euro Area debt essentially non-viable.

Thus the crisis is in grave danger of turning critical, with market attention increasingly focusing on the viability and the sustainability of the common currency itself. As President Barack Obama said recently the key question that now needs answering is who (or what) stands behind the Euro? "Until we put in place a concrete plan and structure that sends a clear signal to the markets that Europe is standing behind the euro and will do what it takes, we are going to continue to see the kinds of market turmoil we saw," he told a news conference in Canberra last week. The key point to grasp is that we are talking about money here. What is the financial backstop which lies behind and guarantees the currency?

This has put the spotlight on the ECB as an institution, but the bank is reluctant to adopt the role of ultimate guarantor. This is not principally due to the so called "inflation fear" - demand driven inflation is extremely unlikely in the Euro Area in the near term - but rather due to a fear of accumulating sizeable losses in the event that large quantities of bonds are purchased and then countries like Italy and Spain have to restructure their debt. The fear in Germany is that the German treasury could then be asked to shoulder the central bank recapitalisation. Hence there is a great reluctance to let this happen. Naturally some argue that a central bank can simply accept losses, since the bank doesn't necessarily need recapitalisation and could be allowed to carry on regardless of the red ink on the bottom line. I am not very convinced by this argument, in part because banking and currencies are all about confidence, and it is not clear to me how the world would react to a headline like "European Central Bank Goes Bust". I think my fears are shared by the Bundesbank, and my intuition is that they are not at all keen to run the experiment just to see what actually happened. As Mario Draghi recently put it, “losing credibility can happen quickly – and history shows that regaining it has huge economic and social costs”.

Hence we have a logjam, with the investor world asking for clarification about who stands behind the Euro, and no one stepping out from behind the curtain to say "I do". In addition there is a kind of "dialogue of the deaf" taking place between the investor community and Europe's political leaders, with the latter asserting that what we have is simply a liquidity crisis, while the former are not convinced, and often consider that what we are facing to be a solvency crisis. The lastest proposal to emerge - that the ECB lend to the IMF who then lends to countries like Spain and Italy - simply highlights the sum total of all these difficulties.

According to the argument as it is going the rounds, the ECB is not allowed, according to its charter, to purchase sovereign bonds in the required quantity, or to lend to the stability fund (the EFSF) for the same express purpose. But the EU normally has little difficulty finding its way round initial regulations and treaty clauses when needs must (wasn't there an opinion once that bailouts would be illegal?), and in this case I am sure that if there were a will there would be a way. The problem is, as I am suggesting, there is no will for this solution from the German political leadership, due to the kind of losses which could be incurred. So the ECB asks the IMF to accept a loan and then lend on its behalf, but is this solution really credible? If a bank doesn't want to lend to a client due to concerns about the ability of the client to repay the loan, why should a neigbouring bank accept a loan from the first bank in order to lend to a client the latter does not want? What is involved here is a risk transfer, and it is not clear that non-European members of the IMF have any more stomach for accepting the losses which have been generated by 10 years of the Euro experiment than the core members of the Euro Area have. The UK posture in this regard is indicative - "you made the mess, now you clean it up".

Of course, matters are not that simple. In the first place the global economy is experiencing a slowdown, a slowdown which is in part being fuelled by the decline in global risk sentiment associated with the European debt crisis. So everyone has an interest here in finding solutions. The rise in bond spreads in both France and Austria is associated with a similar process.

In the French case investors are worried about the sustainability of French debt should Italy be forced out of the Euro, or be forced to restructure. French banks have something like 400 billion euros in exposure to Italian debt (both public and private), and were anything bad to happen to Italy then something bad would also inevitably happen to France. Which illustrates another feature of the crisis, the interconnectedness - via debt chains - of all the Euro Area economies. In principle the French economy is sound. It doesn't have an irresponsible government spending problem, and it didn't have a housing boom. Certainly the French economy is in need of structural reforms, especially in the labour market area, but it is not a deeply sick economy in the way that most on the periphery are. So the fact that French sovereign debt stability is now in question is a huge warning signal that things here could rapidly get out of hand.

The Austrian case is similarly worrying. "Contagion" means what it says, that parts of the body economic which get infected risk passing the infection to previously healthy parts if the underlying issues are not treated rapidly. This is what is now happening, and the clearest example is in the East, where many economies are now slowing rapidly as a result of the crisis in the Euro Area. This is putting pressure on debt instruments in the region - and in particular in Hungary - and this increase in risk aversion is then feeding back into Austrian bond yields due to the Austrian bank exposure to the East of Europe.

So basically we are all in this together, whether inside the Euro Area or out of it, here in Europe or in China or the United States. It is vital that some clear solution is found to the problem, and in particular that Europe make some rapid institutional changes which put real money on the table, and in sufficient quantity to calm the markets. Basically this means a common fiscal treasury in tandem with a much more interventionist ECB. Will this happen? At this stage in the game it seems unlikely, but then the alternative is the abysss, and peering directly into the abyss does have the strange property of concentrating people's minds, so you never know. Another possibility, which I have actively advocated, would be to divide the Eurozone in two, between a Northern core and the Southern periphery. This would be doable technically, and while being far from perfect would certainly go a long way towards easing the present stresses, but again, it would need clear, co-ordinated and determined action from the European leadership, and given everything we have seen so far there is little to suggest they will be able to rise to the challenge.

So we have the last "alternative" which is simply that markets push the issue to the limit, the centre does not hold (Germany, for example could be threatened with being stripped of its triple A), and the whole thing flies apart in the most disorderly and disaggreeable of fashions. If you were to ask me at this point which of the three above alternatives I considered most probable, I would have to say the latter, although naturally in no way do I wish this to happen, it is simply the risk that Europe's leaders are now taking. The worst part is that if involuntary Euro fragmentation did occur it could all happen very quickly indeed, as was the case with the initial attempt at EMU in 1992, although unfortunately this time round the consequences would be much more serious.

Barcelona International Network: What can the incoming PP government do in the face of this situation?

Edward Hugh: Despite popular beliefs in Spain - where a great deal of importance and attention is focused on the political dimension of economic crises - the sad truth is very little. This reality is even evident in the last statements of Jose Luis Rodriguez Zapatero (who called for the ECB to act vigorously) and Economy Minister Elena Salgado (who stated bluntly that the problem was a European and not a Spain specific one) just before leaving office. The new government will be caught on the horns of a dilemma, since the 2011 fiscal deficit is widely expected to come in at over 7% of GDP as opposed to objective set in the Stability Programme of 6%. Mariano Rajoy can either try to dodge the bullet or accept the challenge that this situation presents.

If he tries to dodge it - and according to one theory currently going the rounds the PP would like to pospone any deep cuts till after the Andalusian elections in the spring - then he will be dead on the starting block, despite being elected with the largest majority ever obtained by his party in the Spanish parliament. People who talk of trying to hold out till the spring are simply totally out of touch with the reality and the urgency of the present crisis. On the other hand, if he accepts the challenge, he could wind up a victim of market sentiment just the same.

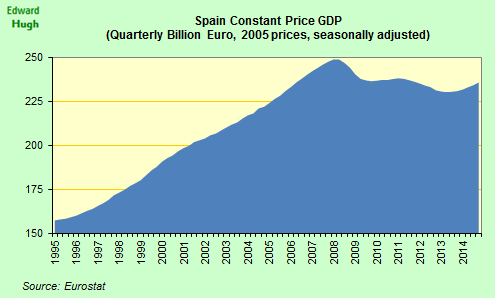

Basically Spain's economy barely recovered from the previous recession and is now entering a second one. House prices have not ceased falling, and unemployment has been rising uninteruptedly since the end of 2007. This situation is putting enormous strain on the financial system, with all parties effectively agreed that the Spanish financial sector needs a second restructuring. The problem is there is no funding available for this at the Spanish level, hence eyes had been looking towards the European Stability Fund (EFSF) for support in this sense. But in the current environment the EFSF is also struggling to finance itself, and herein lies the problem. The present situation is unsustainable, not only due to the high cost of funding Spanish debt, but due to the liquidity pressures that the falling value of Spanish government bonds is placing on the banking sector. The latter problem is much more important than the former in the short term, and indeed it was this pressure on bank liquidity (and not the sustainability of sovereign debt as such) that pushed first Ireland and then Portugal into a bailout. If we add to this problem that Spain's initial financial restructuring process is already leading to an acute credit squeeze which is basically strangling the real economy on the vine, then basically you have all the seeds of a truly full blown crisis.

According to the latest EU Commission forecast, the Spanish deficit next year is expected to be 5.9% of GDP rather than the 4.2% objective set down in the EU stability programme. If Mariano Rajoy applies the kind of spending cuts which would be required to bring the deficit into line with targets in the context of an economic recession, then the probability is that Spain would have a rather severe economic contraction in 2012, similar to that which is currently occurring in Portugal. On this scenario the impact on unemployment would be severe (JP Morgan is already forecasting Spanish unemployment could rise to 27% in 2012), and the knock-on effect of this on non-performing loans in the banking sector correspondingly negative, and so on and so forth. So whichever way you look at it, Mr Rajoy is certainly facing a "heads I lose tails you win situation", with no easy solution.

Which is why I say at the outset that the response has to come at the European level. The era of single country rescues has really come to and end with the arrival of Spain and Italy in the casualty unit. Both countries are of course, too big to save in the conventional sense, while at the same time if they both fail then the Euro in its present form is surely finished. In addition, the political dimension is much larger. Italy is not Greece, and Spain is not Ireland. It would be impossible to treat either country in the way which their smaller peers have been treated, and Europe's leaders are well aware of this.

So we are back to the backstop for the Euro, making large quantities of funding available to both sovereign debt issues and to the financial sector restructuring one, a restructuring which would almost certainly involve the costly creation of a bad property bank in order to take the large accumulated volume of toxic assets of balance sheets and free the system up for the provision of more normal credit. But as I said earlier, all we have from Europe's leaderes at this point are vague promises coupled with silence on the key issues. A silence which becomes more and more deafening with each passing day. As ECB President Mario Draghi put it at the end of last week - highlighting the failure of governments to make operational the European Union’s bail-out fund, the European Financial Stability Facility, launched 18 months ago - “Where is the implementation of these longstanding decisions?”

Barcelona International Network: What specific effects are future developments likely to have on Catalonia's relations with the rest of Spain? Given the substantial PP majority in the Spanish Parliament, do you see increasing political tension between a centralist nationalist government and a Catalan administration under increasing citizen pressure to exercise the right of self determination, or do you believe sufficient common ground will be found to make agreement and cooperation achievable to address the current economic issues?

Edward Hugh: Well, as you probably know the situation here in Catalonia is very difficult. The cutbacks in public spending here have been very severe, more or less 10% across the board including in key areas like health and education. Yet despite this the underfunding of the region is so severe that the government is not going to be able to comply with the 1.3% of GDP deficit target laid down for 2011 by the central government. This year's deficit is likely to be around 2.6% of Catalan GDP but the government in Barcelona has made no secret of this, since it always considered the proposed reduction too drastic to carry out in one year. It is important to understand here that Catalonia has a large fiscal SURPLUS with the rest of Spain, maybe 8% of Catalan GDP.

Catalonia is one of Spain's richest regions, and effectively subsidises spending in other parts of Spain. Most Catalans accept this, and accept that their region should make some contribution to balancing disequilibriums across the Spanish territory. What Catalan citizens cannot understand is the extent of their contribution, and why it is that their regions should be receiving swingeing health cuts while other areas seem to be able to avoid them whether by hook or by crook. So this is a very unstable situation.

Catalans are also pretty fed up with the lamentable efforts of the previous Zapatero adminstration to find solutions to the economic crisis and to find ways of improving their financing problems - it is important to remember that Catalonia is one of the richest and most productive regions in Southern Europe, yet Catalan debt is treated scarcely better than Greek debt by the financial markets. We do not deserve this.

My feeling is that the new Rajoy adminstration will go to some considerable lengths to try to avoid confrontation with the Catalan administration, and many Catalans will be ready and willing to respond to such overtures. I well remember close Mariano Rajoy adviser Baudilio Tomé saying to me "Edward, you are one of those Catalans who recognises when Spain goes well, Catlonia goes well, and for Spain to go well, Catalonia has to go well". And yes I, like many others, take this view. The thing is, Spain isn't going well, and in the near future it is unlikely so to do.

In addition the new government's room for manoeuvre may be very constrained. The Catalan Parliament is preparing a new financing proposal, but in the short term anything which improves Catalonia's situation is inevitably going to make the position in some other parts of Spain worse, so this is going to be an aspiration which it will be hard for a Spanish nationalist party to fulfil. So while in the short term there will be conciliation, in the longer run confrontation would seem to be far more likely, given the diametrically opposed aspirations of the various parties.

Naturally, any kind of disorderly Euro disintegration would add to these strains enormously. I recently attended an experts meeting on the legal background to state creation. It was really fascinating stuff, but what I was most surprised to learn was that in the event of a Catalan declaration of independence, and absent an amical agreement between Spain and the new state, the liability for servicing existing debt issued by the Spanish state would fall on Spain and Spain alone. This would mean that the country without the Catalan financial contribution would be virtually immediately bankrupt. This is a daunting thought, and should serve to concentrate everyone's minds in the months and years to come. Catalonia could easily finance itself and live up to its responsibilities outside Spain. The same cannot be said of the parent country absent Catalan financing. I think it's high time for a change of mindset in Spain about this reality, and time that Catalonia's problems were treated with the respect and importance which they deserve.

Spain Real Time Data Charts

Edward Hugh is only able to update this blog from time to time, but he does run a lively Twitter account with plenty of Spain related comment. He also maintains a collection of constantly updated Spain charts with short updates on a Storify dedicated page Spain's Economic Recovery - Glass Half Full or Glass Half Empty?

Monday, November 21, 2011

Wednesday, August 17, 2011

Going Dutch - One Possible Solution To the Euro Debt Crisis?

Looking back over the last 18 months of Europe’s debt crisis, European Central Bank Executive Board member Lorenzo Bini Smaghi recently invoked Winston Churchill’s famous quip, “You can always count on Americans to do the right thing -- after they’ve tried everything else.”

Europeans too, he assured his audience would also get it right, eventually. Unfortunately all the coming and going, procrastination, denial and half measures we have seen since the Greek crisis first broke out have not come without a cost, and this cost can be seen in the growing lack of confidence in the markets that a lasting solution to the underlying problems of the common currency will finally be found. Only adding to the problems, even the Americans seem to be having difficulty finding the right thing to do this time round, or at least doing it at the right moment, as the market turbulence following the S&P downgrade has served to underline.

It’s probably too soon to say whether what Europe’s leaders are about to agree on what will ultimately be the “right thing”, but at least there now does seem to be a general recognition that a defining moment is fast approaching, and fundamental changes to the continent’s institutional structure are now on the table. Among the options now being openly advocated and debated is to be found a measure thought unthinkable a year ago -- ending Europe’s 13 year experiment with a single currency. But even if this ultimate possibility – the so called nuclear option – were to come to pass, as always there would be a right way and a wrong way of going about it.

Few Now Doubt The Gravity Of The Situation

The latest round in the European sovereign debt crisis has been, without a shadow of doubt, the most serious and the most potentially destabilising for the global financial system of any we have seen to date. Pressure on bond spreads in the debt markets of the countries on Europe’s troubled periphery have become so extreme that the European Central Bank (ECB) has been forced to make a radical and unexpected change of course, intervening with “shock and awe” in the Spanish and Italian bond markets. During the first week following the change in policy the bank bought bonds worth a minimum of 22 billion euros. To put this number in some sort of perspective, the entire bond purchasing programme to date for Greece, Ireland and Portugal has only involved some 74 billion euros, and this in over a year of intervention.

Along with earlier interventions in Ireland, Portugal, and Greece, the central bank has become the “buyer of last resort” of peripheral Europe’s bonds, but this can only be an interim measure, since the volume of bonds which would need to be purchased on an ongoing basis simply to stop the Spanish and Italian bond yields rising is so massive that it would put the bank well outside the limits of its original founding charter. It would also put the central bank in need of substantial recapitalisation should Italian and Spanish debt need to be restructured at some point.

And as if all this was not enough, adding urgency to difficulty even core countries like France are now finding themselves drawn into the fray, while the risk of contagion spreading to the East is now far from negligible. The French spread, the extra yield investors demand to buy 10-year French debt rather than German bunds, has jumped to 87 basis points, even though both carry AAA grades from the major rating companies. According to Bloomberg data, this is almost triple the 2010 average of 33. Credit-default swaps on France now trade at around 175 basis points, more than double the rate for protecting German securities.

In addition pressure in both the US and Europe over the debt issue have lead other currencies like the Swiss Franc or Yen (in addition to gold) to very high levels, which in the case of the Franc has a direct impact on households and companies in those East European where borrowing in CHF has been prevalent. This surge in the Franc has already produced worrying repercussion in Hungarian financial markets raising the spectre of contagion spreading to the East.

The gravity of the situation was highlighted when the European Commission President Jose Manuel Barroso explained to waiting reporters at the height of the latest crisis that the current "tensions in bond markets reflect a growing concern among investors about the systemic capacity of the euro area to respond to the evolving crisis."

To be clear, the issue involved is no longer one of the mechanics of Greek debt restructuring, or of the extent of private sector involvement in any such debt adjustment, or even the of the value of the already agreed upsizing of the capacity of the European Financial Stability Fund (EFSF, the bailout mechanism). The current crisis is an existential one, which if left unresolved will rapidly become a matter of life of death for the single currency. In a portent of what may now be to come, at the very same moment in which the board of the ECB was reaching agreement on its latest programme of bond purchases preoccupations were already being aired in Berlin that the sums involved in a generalised rescue might be too large for even the richest countries in the core to accept.

In fairness to Mr Barroso, what he was suggesting was not that the Euro itself was on the verge of collapse, but that there had been a deep and significant shift in market perceptions of the crisis, and that this shift required a new and much more fundamental response from Europe's leaders and institutions. It is the capacity of these leaders to agree on even the broad outlines of a viable and effective response which is at the heart of all the market nervousness, and in this sense the recent decision by the rating agency Standard and Poor's to lower downgrade the US sovereign has only served to complicate further an already complicated situation.

So why this abrupt and dramatic change in the way the game is being played? Undoubtedly the lion’s share of the explanation is to be found in the arrival of a new, and to many unexpected, elephant in salons of European power. With something like 1.9 trillion Euros in outstanding debt, Italy is the planet's third largest issuer of sovereign bonds (following Japan and the United States) and although the relatively high savings rate of the Italian private sector (both families and corporates) means that much of the debt is in Italian hands, the deep interlocking of Europe's financial system (which is a by-product of the deep and liquid bond markets which came into existence following the creation of the common currency) means that a considerable portion is not.

In a certain sense the Italian crisis has crept up on market participants and caught them unawares. The reason for the relative unexpectedness of the scale of Italy’s problems is in part historical accident (that it was Greece, and not say Ireland, that got into trouble first) and in part a reflection of the need for market discourse to find a single and unified focus, and in this case the focus was on deficit and not debt. To put it simply, all too often market discourse could be described as suffering from some kind of “one track mind” syndrome.

The high profile given to the Greek issue meant that to a large extent Europe’s problems were perceived as being fiscal deficit ones, with more fundamental issues like lack of convergence, current account imbalances, cumulative debt and low economic growth all being pushed well into the background. Now things have changed. As former UK Prime Minister Gordon Brown put it recently: “Now no number of weekend phone calls can solve what is a financial, macroeconomic and fiscal crisis rolled into one”. Solving the crisis involves “a radical restructuring of both Europe's banks and the euro, and will almost certainly require intervention by the G2O and the International Monetary Fund”.

Historic Issue With The Euro

Perceived by many as being ill-gotten and ill-born, the issue of Euro parentage has long been a topic of intense debate and controversy, most notably between economists on one side of the Atlantic and those on the other, and between micro- and macroeconomists. There simply has been no consensus on what in fact the problem is, and criticisms from the United States of the way the crisis has been handled in Europe are often felt to be unfair and misplaced. As ECB Executive Board Member Lorenzo Bini Smaghi put it in July speech to the Hellenic Foundation for European and Foreign Policy, in the United States a significant financial crisis does not call into question the whole institutional and political set-up, and the dollar itself is not considered to be at risk. In Europe, in contrast, a crisis is often considered by outside observers as putting the euro, and the Union itself, at risk of disintegration. “Academics and other experts deliberate on whether the euro area is viable and how it can be rescued. Closet eurosceptics suddenly reappear, dusting off their I-told-you-so commentaries”.

Whilst Mr Bini Smaghi undoubtedly puts his finger on the core of the issue in this statement, and most certainly reflects the level of frustration felt by key players in European decision making, analogies with individual states in the Union simply fail to get to the heart of the reason for much of the preoccupation. It is not simply a question of “closet” (or open) eurosceptics suddenly reappearing, but of the monetary union repeatedly showing fault lines exactly where many of those much berated macroeconomists had expected they might appear. This is why Mr Brown is undoubtedly right to focus on the fact that beyond an immediate fiscal crisis, what we have in Europe is also a crisis of macroeconomic management and of financial stability. As he so eloquently puts it, what many were worried about was the fact that the initial Euro design contained "no crisis-prevention or crisis-resolution mechanism and no line of accountability when things went wrong".

Naturally Gordon Brown is far from being the first to have voiced such views. The fact that economies in Europe’s core and those on the periphery far from having converged have actually been diverging under the watchful eye of ECB monetary policy has long been a cause for concern in macroeconomic circles. In particular, at the heart of the monetary union’s current problems lie the huge imbalances which have been generated between the economic “surplus” countries in the core, and the external deficit ones on the periphery. Europe’s leaders have long avoided biting the bullet, and indeed could be considered to be in deep denial, over the significance of this issue. Referring to the prevailing voices among European policymakers former IMF Chief Economist Simon Johnson put it this way:

The fig-leaf of Europe’s nations being somehow equivalent to US states has long been held up to justify the idea that the common currency was in general working well, and that the problems involved in managing it were being greatly exaggerated. With the arrival of the Italian elephant onto the centre stage at a stroke this argument has become as outdated as the institutional structure which lay behind it, since few of core Europe’s leaders are really willing to accept the responsibility for giving full and lasting guarantees for the country, quite simply because it is not just one more state in a fully integrated union, but a sovereign nation with all that that implies.

Having said this, there can be no doubt that Europe’s leaders have made huge strides forward in their attempts to get to grips with the issues as they have presented themselves, even if the measures taken so far continue to fall woefully short of what will eventually be needed. As the crisis has moved on from the initial concerns about Greek accounting methods, the piecemeal approach adopted by European policymakers has lead them to erect what is now a veritable production line of crisis resolution instruments and departments, with each of the needy patients being situated at different stages of the treatment process. In the Greek case the underlying issue is now acknowledged to be a solvency one and teams of experts are hard at work in a seemingly endless struggle to try to decide just what degree of restructuring (and/or reprofiling) Greek debt will finally need. In the Irish and Portuguese cases the task still remains one of monitoring programme implementation, with the focus being on whether or not they will eventually require (Greek style) a second stage bailout package. Meanwhile in the antechamber, the Spaniards and the Italians patiently wait their turn, while the doctors and health system administrators hold a heated debate as to whether there is enough space available in the emergency ward, and whether the patients have sufficient insurance to cover them should the surgery need to be drastic.

Too Big To Fail (Or Save)

What now brings a renewed sense of urgency to the whole process is the question of whether Spanish and Italian bonds could soon find themselves shut out of the financing markets in the way their smaller predecessors were before them. The latest ECB decision to intervene in their bond markets would seem to make it more rather than less likely that they eventually will be, since it is hard to see how they can now move back to unsupported market prices.

One of the curious anomalies about how the debate is currently being framed is the way in which banks and money funds who have invested in Europe’s periphery are being told that it is only right they should now assume some part of the anticipated debt restructuring burden due to their earlier policies of “irresponsible lending”, while these very same investors are also being urged to purchase new issues of just this very debt, on the argument that risk is exaggerated since the countries concerned have essentially sound economies, and are only suffering from short term liquidity and balance of payment type problems.

The underlying dilemma for such institutions has been highlighted by the decision of the Italian market regulator Consob to request information on the recent move by Deutsche Bank to reduce its exposure to Italian government debt. Banks have some responsibility to their clients, and will not normally knowingly take decisions which will lose money for them. So it is only rational for them to try to “lighten up” their positions on some of Europe’s weaker sovereigns. What isn’t credible is for political leaders to at one and the same time tell the banks that they are lending irresponsibly and urge them to purchase debt which may well end up being restructured. Thus the recent insistence on private sector involvement in Greek restructuring is often not unnaturally seen as one of the triggers for financial institution flight from Spanish and Italian bonds.

The Deutsche Bank case is a good illustration of the problem being faced by both the banks themselves and by those trying to maintain confidence and stability in the sovereign debt markets. According to data from the bank’s quarterly results it reduced its net exposure to Italian sovereign debt from 8 billion euros in December 2010 to 997 million euros at the end of last June. To put this in some sort of perspective, over the same period it cut its exposure to Spanish debt by some 53% (to 1,070 million euros) while the reduction in their Italian debt holdings was of the order of 87.5%. It is this difference in velocities of sell-off which in large part explains the recent surge in Italian bond yields, making it now potentially more expensive for Italy to finance itself than it is for Spain. And the reason for this is simple: previously Italy was seen as effectively isolated from contagion problems on the periphery, while Spain was not.

While yields on 10-year Italian government bonds have now fallen back significantly from their earlier euro-era highs, Spain’s have fallen further, and before the ECB intervention Italian yields had risen 1.26 percentage points since the end of June while Spanish yields had only risen by about half that amount.

Really the Italian situation is by far the most complex one facing the Euro system at this point in time. In the years prior to the outbreak of the financial crisis in 2007 Italy’s debt had long been a focus of attention among those who were worried about the effectiveness of the Euro Area’s Stability and Growth Pact whereby countries were expected to maintain deficit levels below 3% of GDP annually, and cumulative debt levels below 60% of GDP. In fact, according to IMF data, gross Italian government debt hasn’t been below 100% of GDP since 1991, and the country entered the financial crisis with a level of around 103% of GDP. During the crisis the country remained beyond the searching gaze of financial market interest by keeping its annual deficit at comparatively low levels, but a combination of recession, low growth and a substantial interest payment burden on the already accumulated debt has seen the level rise steadily to an estimated 120% of GDP this year.

Effectively Italy is poised on what is often termed a “knife edge”, since in order to stop this percentage snowballing upwards the country needed a growth rate in nominal GDP (that is uncorrected for inflation) of around 3% a year, and this at the rates of interest being paid before the recent surge. This effectively means a growth rate of 1% and an inflation rate of 2% (on average, and over a significant period of time). This growth number may not sound too ambitious, but as the Italian economist Francesco Daveri points out, Italy’s average annual GDP growth rate has been falling by around 1% a decade since the 1970s, and average growth between 2001 and 2010 was only around 0.6% per annum.

After falling by something like 6.5% during the crisis the Italian economy did manage to grow by 1.3% in 2010, but growth in the first half of this year has already been weak, while all forward looking indicators suggest it will be weaker in the second half. Thus analyst estimates of an eventual 2011 0.8% growth rate seems if anything optimistic, and with the IMF forecasting 1.9% inflation during the year, the numbers just don’t add up.

And that, of course, was before interest rates started to rise. While the new higher interest rates won’t have a huge impact in the short term, as existing debt needs to be steadily refinanced the extra cost will simply mount and mount. Which is why the Italian government is in a huge bind. It doesn’t have a debt flow problem, it has a debt stock problem, and as the risk premium charged on Italian debt rises and rises, and as the growth outcomes fail to meet the often optimistic targets, then the snowball of debt steadily slides its way down the mountain side with little the government can do to stop it growing as it moves. Like some modern Sisyphus, they are condemned to struggle with a monumental task where advance seems well nigh impossible. Out of good taste it would be better not interrupt them in their labours to ask whether, Camus style, they are still able to maintain a smile on their face.

They Ain’t Coming to Bailout, No..., No..., No..., No..., No!

Those who most definitely are not smiling at this point in time are German politicians and voters. As Christian Reiermann comfortingly informed Der Spiegel readers recently: “The euro zone looks set to evolve into a transfer union as it struggles to overcome the debt crisis. There are a number of options for the institutionalized shift of resources from richer to poorer member states -- and Germany would end up as the biggest net contributor in every scenario”. These are emotive times, but feelings of outrage are not necessarily the most reliable guidelines to steer by in the search for durable solutions to complex problems.

The Italian hit may well be the most recent and the most spectacular the common currency has suffered in the 10 short years of its existence, and it may have created the problem which is quite literally too big to handle with the present institutional structure, but it really is only the latest example of that complex mix of fiscal, macroeconomic and financial issues that have come to plague the Euro which Gordon Brown draws attention to, and these issues do, by and large, go back to a design fault which was in there from the start. So while Europe’s unhappy families may all be unhappy for a variety of different reasons, the root of the problem is that the project as it was set up contained all the mechanisms for creating the problems, but few of the ones which would be needed for resolving them.

Large structural distortions were able to build up over the earlier years of the currency’s life, but now it is very hard to see where the much needed remedies are to come from. Some sort of fiscal union is now widely if belatedly seen as forming a necessary part of a well-functioning monetary union, but trying to introduce one at this stage in the game, when many of the countries along the periphery have suffered a substantial competitiveness loss in relation to those in the core seems to lead to only one conclusion, the kind of transfer union that so worries Christian Reiermann and so many of his fellow citizens.

Europe already has examples of just this kind of transfer union between higher growth and richer regions and their lower growth and poorer neighbours in Germany, Italy and Spain, and in no case can it be said that such arrangements have proved popular with those who are asked to be the net contributors. So it is not hard to reach the conclusion that this kind of fiscal union would be simply unsustainable in the Euro Area context at the present time.

The only real way forward is for those who have lost competitiveness to somehow regain it. This, as we are seeing, is far easier said than done. Most of the proposals which have come from the EU Commission and the IMF to date involve some kind of micro-level productivity-enhancing structural reforms, but these are not able to raise growth rates sufficiently quickly (indeed there is very little real evidence of the extent to which they are able to do this in any event), and inevitably involve the countries involved trying to “out-Germany” the Germans, which culturally on the face of it seems to present them with an almost impossible challenge, especially when German companies are hardly marking time themselves.

Normally, the classic solution in this situation would have been some kind of devaluation, but obviously these countries have no currency left to devalue. Another possibility would be the kind of “internal devaluation” process which has been tried in the Baltics, and a number of macroeconomists (myself included) have been arguing for this, but the complete lack of any kind of positive response makes the viability of even this approach hard to contemplate, and anyway, systematic deflation would in many cases only make the debt problem worse.

Euro At The Crossroads

So the Euro is now at the crossroads, and important decisions need to be taken. Preserving the Eurozone -- as it is now -- might be workable if it were possible to transform the Eurozone into a full fiscal union where budgetary policy was coordinated across nations by a central treasury in the way major programmes are between states in the US. But such an arrangement is a now a political impossibility, as Europe’s core economies would inevitably reject what would be seen as a permanent transfer union between high-growth regions and their poorer neighbours.

However the present debate about creating Eurobonds is resolved, these alone will not solve the problem at this point, and, as many observers are noting, may even make matters worse by weakening the sovereign credit ratings in the core. In the longer run they could form part of a more general solution, but the moral hazard dimension they entail means that in the absence of a fix for the immediate competitiveness problems on the periphery they only risk making the common currency project even more politically unstable. Such is the price for so much procrastination and denial. As Citibank’s Chief Economist Willem Buiter so delicately put it recently, attempts to transform the current bailout mechanisms into a transfer union would be doomed to failure since “the core euro area donors would walk out and the periphery financial beneficiaries would refuse the required surrender of national sovereignty”.

So, with fiscal union effectively off the table, there are basically three possibilities. The first is to stay more or less where we are, maintaining and even expanding the bond purchasing programme of the ECB, and simply trying to hang on in there. The stability fund could be increased, but the more numbers start being accounted in detail the further away the various parties get from being able to agree. If this continues the ECB is likely to reach a ceiling beyond which it will be more than reluctant to continue buying, since the bank takes the view that the resolution has to come from the politicians.

But with Italy and Spain’s combined sovereign refinancing needs between now and the end of 2012 totalling something like 660 billion euros, and the financing needs of the banks to take into account on top, reaching agreement to expand the bailout mechanism on this scale looks like a pretty improbable outcome, especially when you consider that once you are that far in you will simply have to continue all along the road. So at some point the spreads will start to widen again as markets force the issue, with the inevitable outcome that the monetary union is pushed towards the brink of breakdown.

The second possibility would be to disband the union entirely, leaving everyone to go back to their own national currency. This would be a disastrous outcome for all concerned, and for the global financial system. Coordinating the unwinding of cross country counter liabilities would be a nightmare given the level of interlocking in the corporate and sovereign bond markets, and the sudden disappearance of one of the major global currencies of reference would cause havoc in financial markets. The dollar would most likely be pushed to unsustainably high levels in the rush for safety, and it is only necessary to look at what is currently happening to gold, the Swiss Franc and the Japanese Yen to catch a glimpse of what would be in store.

Evidently this kind of violent unwinding would never be undertaken voluntarily, but that does not mean that it is an eventuality which might not take place, if solutions are not found and the force of market pressure continues and even augments.

Fortunately there is a third alternative, even if it is one that at first appears no more appetising than either of the other two: the Eurozone could be split in two, creating two different euro currencies. Naturally the composition of the groups would be a matter of negotiation, since some countries do not easily belong in either one group or the other. The broad outline is, however, clear enough. Germany would form the heart of one group, along with Finland, Holland and Austria.

In addition Estonians have been making it pretty that they would also be up for the ride. Spain, Italy and Portugal would naturally form the nucleus of the second group, with Slovenia and Slovakia being possible candidates. Some countries, Ireland and Greece for example, might simply choose to opt out.

The big unknown is what France would do. In many ways it belongs with the first group, but cultural ties with Southern Europe and political ambitions across the Mediterranean could well mean the country would decide to lead the second group. Naturally if what was involved were not ultimate divorce but temporary separation, then French participation with the South would also have a lot of political rationale. The term Franco-German axis would gain a whole new meaning.

Naturally the technical challenge would be enormous, but it would not be insurmountable. The great advantage of such a move would be that two of the major burdens under which the monetary union is labouring – the lack of price competitiveness on the periphery and the lack of cultural consensus between the participants - would be resolved at a stroke.

No one knows the values at which the two new currencies would initially operate, but for the purpose of a thought experiment let’s assume a Euro1 at around U.S. $1.80 (the euro/USD is currently around US$ 1.40), and a Euro2, at around $1. Obviously, in the short term the winners of this operation would be the members of Euro2, who would get the devaluation their economies have been yearning for. Why would this be? At a time when the countries concerned are loaded down with debt and domestic demand is correspondingly weak, export growth is the only way for their economies to move forward, and the change would allow cheaper labor and production costs, giving them an enormous push in this direction.

And it would encourage growth in other ways. Take Spain as an example. The country has at the present time a large pool of surplus property, on many estimates of around 1 million unsold new housing units. Many have criticised the banking sector for not dropping prices sharply to enable the market to clear, but the banks are understandably reluctant to do this due to the impact this would have on their balance sheets, and due to the knock-on effect on their existing mortgage books. The beauty of this solution is that no further drop in price would be needed, since for external buyers the real price of all this housing would suddenly become much cheaper.

The case of tourism would be somewhat similar, since not only would more tourists come to Spain, they would come for longer and they would spend more. The shopping bags would certainly not be empty on the plane home.

Spain’s troubled savings bank sector has been desperately looking for foreign investors to help them recapitalise, but while many have shown interest virtually none have participated to date. After the devaluation all this would change since they would be able to buy shareholding at attractive prices, and without having to worry about a sudden drop in prices and hence loss of capital.

Spain’s 4.5 million unemployed would gradually start to go back to work, new investment could steadily be attracted for other productive projects in manufacturing industry, no one would doubt the solvency of the Spanish state, and the private sector would be in a better position to start paying back its debts as the economy grew.

Now obviously, as we all know, in economics as in life there are no free lunches, so there must be a catch here somewhere, and of course there is. In fact there are two big “catches”. In the first place those countries who joined together to form Euro1 would be making a big sacrifice, since many of them also depend on exports for their livelihood, and their manufacturers would suddenly and sharply find themselves at a disadvantage. In particular Germany would suffer.

However, assuming that all can agree at some point that the current arrangements are unworkable, and that going back to individual national currencies would be a disaster, then the German sense of responsibility and the country’s commitment to the European project might well make the acceptance of some sort of sacrifice (and especially if it were a sacrifice which offered longer term solutions) bearable. Fortunately, recent German historical experience provides us with two concepts which might just help everyone see their way through this. The first of these is the Treuhandanstalt, the Privatisation institution (and bad bank) which was created to handle East German assets between 1990-1994. The second is Lastenausgleich, or burden sharing, and this refers to the mechanism which was used to share the unequal outcome of WW II between Germans who found themselves living in the West: between those who had come from the East and lost everything and those who were from the West and had retained something.

The Treuhandanstalt experience is useful in helping us to think about how to handle the common set of assets/liabilities acquired during the initial Euro stage. Think about Spain’s banks and their property assets. These would now be sold in Euro2, but many of the liabilities which correspond to them are in fact liabilities with institutions who will find themselves in Euro1. Marking them to market immediately, and in Euro2, would produce sizeable losses in the Euro1 financial sector. Some of these losses are inevitable and to some extent correspond to the kind of restructuring haircuts which are now being contemplated. But in the initial period (and for reasons which will become clearer below) it would be advisable not to mark them to market, but to hold them for a specified time in a common institution of the Treuhandanstalt kind.

As I say, some losses are now inevitable, and this is where the second concept from recent historical experience – Lastenausgleich, or burden sharing – becomes important. Despite protests to the contrary from Lorenzo Bini Smaghi (link) the Euro experience to date has not been a success for any of the participants once you add-in the potential losses which are now looming. At the same time the common currency has been a shared experience, in which all have taken part, so it is not unreasonable to assume that all should share when it comes to the downside. The problem with the measures adopted to date is that they are perceived on both sides of the fence as unfair. Those who are funding the bailouts feel that they are being asked to pay for the “excesses” of the recipients, while those who receive feel that what they are getting is not help, but loans which make it easier for the financial sector in the donor countries to avoid declaring losses. This “communicational impasse” is one of the major reasons the current approach won’t work.

What is needed at this point is an appeal to the European spirit of the Euro1 countries, in a way which helps them to see that some costs are unavoidable, but that any agreed costs will be shared, and above all that the game-changing solution is workable and offers some sort of constructive positive future for all Europeans. Put in other words, what we need is a mechanism which contains both realism and idealism in just sufficient proportions.

The advantage that the split Euro option has over all the other proposals on the table at the present time is that it would address the growth issue head on. The countries on Europe’s periphery could return to growth, and once the economies involved start growing rather than shrinking the proportion of the liabilities incurred during the earlier period which they will be able to pay rises significantly. It is much more difficult to collect debts from an unemployed household than it is from one which is gainfully employed.

Another attractive feature of this proposal is that no “in principle” decisions would need to be taken about the long term structure of the European financial system. The ECB could be retained as a kind of holding entity and clearing house for the outstanding financial mismatch, and the current national central banks could be grouped into two separate sub-entities. This would leave open the possibility of reconvergence at a later date should conditions obtain which would make the move viable. The first stab at creating a currency union has failed, but this doesn’t mean that any possibility of creating one in the future should be abandoned. Hard and costly lessons have been learned, and what is now needed is a full and open discussion of the reasons for failure, precisely to avoid similar mistakes being made in the future.

Having the move co-ordinated by pan-European institutions has another advantage, and that is to do with the degree of conditionality the process must involve. Devaluing their currency would, as I have suggested, give a great short term boost to growth in countries along the periphery, but this short term boost would only be converted into a long term sustainable improvement in trend growth if a lot of other things were done too. It is very easy to laud the great advance Argentina made on breaking the dollar-peg, but look where Argentina is today. This “short sharp shock” treatment only has a lasting impact (as it did in Scandinavia in the 1990s) if measures to improve institutional quality (reformed labour and product markets, productivity and innovation drives) are implemented and maintained. Here again partnership is needed, since while giving back to the periphery “ownership” over its own reform programmes would be another significant advantage of the arrangement, the reform process would need to remain under the auspices of a common European project, one which could lay the basis for a consensually grounded lasting political union, a union which would be the essential precondition for any future attempts to move back towards greater monetary integration.

Effectively Europe’s leaders are caught in a kind of Pavlovian trap. There are no easy choices, although there are good ones and bad ones. Staying where they are leaves them in a kind of permanent electric shock zone where their constant feeling of failure only serves to further deteriorate their own sense of personal and political worth. Advancing also seems painful, but more than the intensity of the shock it is the sensation of fear and angst which dominate. Still there is no alternative but to advance, since you cannot stay where you are. Simply applying administrative measures to force stability onto a financial system which resists with all its might will only result in increasingly destabilizing behaviour (read “speculation”) by the agents within the system. Administrative fiat simply represses and pushes forward instability (read” kicks the can down the road”), leading the system itself to become ever more inefficient. In any malfunctioning financial system, as the late Hyman Minsky famously said, “stability is itself destabilizing”.

Perhaps it is appropriate to close this essay where it started, with a quote from ECB Board member Lorenzo Bini Smaghi: “as J.K. Galbraith observed: “Politics consists in choosing between the disastrous and the unpalatable”. To see disaster looming before choosing the unpalatable is a dangerous strategy”.

This article is an expanded version of one which was originally published on the website of the US magazine Foreign Policy, under the title "The Euro and the Scalpel"

Appendix - The Way To Split The Euro

This article was written during 4 days I spent in Marbella earlier this month in the home of my friend and colleague Detlef Gürtler (author of the recent book Entschuldigung! Ich Bin Deutsch (Sorry, I'm German, Mermann Verlag GmbH, Hamburg).

While I was busying myself with the text, Detlef was working on the images (which can be found above), and on some illustrative material for the technical side.

These graphics only give some illustration of just how complex any unwinding of the commen currency would be, given how interlocked the financial sectors of the participating countries have become.

Some sort of holding entity would need to accept responsibility for a whole range of problematic assets during any transitional period. This entity could be the ECB. The though behind the idea that not everything should be marked to market immediately is that the Euro2 countries are nothing like so weak as the initial value of the new currency would suggest, nor are the Euro1 countries so strong as is often thought. So inevitably the parity at which the two would exchange would converge towards a much tighter band, which would be much closer to the real competitiveness difference between the various countries. Naturally it would make a lot more sense to mark to market at this point, since the losses to be borne on both side would be that much smaller.

It is also worth stressing that this solution is far from perfect. We do not live in an ideal world. It is only one possible way of breaking the vicious circle into which the Euro Area countries have now fallen. It is one possible way, and as far as I can see the only viable and realistic one.

This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

Europeans too, he assured his audience would also get it right, eventually. Unfortunately all the coming and going, procrastination, denial and half measures we have seen since the Greek crisis first broke out have not come without a cost, and this cost can be seen in the growing lack of confidence in the markets that a lasting solution to the underlying problems of the common currency will finally be found. Only adding to the problems, even the Americans seem to be having difficulty finding the right thing to do this time round, or at least doing it at the right moment, as the market turbulence following the S&P downgrade has served to underline.

It’s probably too soon to say whether what Europe’s leaders are about to agree on what will ultimately be the “right thing”, but at least there now does seem to be a general recognition that a defining moment is fast approaching, and fundamental changes to the continent’s institutional structure are now on the table. Among the options now being openly advocated and debated is to be found a measure thought unthinkable a year ago -- ending Europe’s 13 year experiment with a single currency. But even if this ultimate possibility – the so called nuclear option – were to come to pass, as always there would be a right way and a wrong way of going about it.

Few Now Doubt The Gravity Of The Situation

The latest round in the European sovereign debt crisis has been, without a shadow of doubt, the most serious and the most potentially destabilising for the global financial system of any we have seen to date. Pressure on bond spreads in the debt markets of the countries on Europe’s troubled periphery have become so extreme that the European Central Bank (ECB) has been forced to make a radical and unexpected change of course, intervening with “shock and awe” in the Spanish and Italian bond markets. During the first week following the change in policy the bank bought bonds worth a minimum of 22 billion euros. To put this number in some sort of perspective, the entire bond purchasing programme to date for Greece, Ireland and Portugal has only involved some 74 billion euros, and this in over a year of intervention.

Along with earlier interventions in Ireland, Portugal, and Greece, the central bank has become the “buyer of last resort” of peripheral Europe’s bonds, but this can only be an interim measure, since the volume of bonds which would need to be purchased on an ongoing basis simply to stop the Spanish and Italian bond yields rising is so massive that it would put the bank well outside the limits of its original founding charter. It would also put the central bank in need of substantial recapitalisation should Italian and Spanish debt need to be restructured at some point.

And as if all this was not enough, adding urgency to difficulty even core countries like France are now finding themselves drawn into the fray, while the risk of contagion spreading to the East is now far from negligible. The French spread, the extra yield investors demand to buy 10-year French debt rather than German bunds, has jumped to 87 basis points, even though both carry AAA grades from the major rating companies. According to Bloomberg data, this is almost triple the 2010 average of 33. Credit-default swaps on France now trade at around 175 basis points, more than double the rate for protecting German securities.

In addition pressure in both the US and Europe over the debt issue have lead other currencies like the Swiss Franc or Yen (in addition to gold) to very high levels, which in the case of the Franc has a direct impact on households and companies in those East European where borrowing in CHF has been prevalent. This surge in the Franc has already produced worrying repercussion in Hungarian financial markets raising the spectre of contagion spreading to the East.

The gravity of the situation was highlighted when the European Commission President Jose Manuel Barroso explained to waiting reporters at the height of the latest crisis that the current "tensions in bond markets reflect a growing concern among investors about the systemic capacity of the euro area to respond to the evolving crisis."

To be clear, the issue involved is no longer one of the mechanics of Greek debt restructuring, or of the extent of private sector involvement in any such debt adjustment, or even the of the value of the already agreed upsizing of the capacity of the European Financial Stability Fund (EFSF, the bailout mechanism). The current crisis is an existential one, which if left unresolved will rapidly become a matter of life of death for the single currency. In a portent of what may now be to come, at the very same moment in which the board of the ECB was reaching agreement on its latest programme of bond purchases preoccupations were already being aired in Berlin that the sums involved in a generalised rescue might be too large for even the richest countries in the core to accept.

In fairness to Mr Barroso, what he was suggesting was not that the Euro itself was on the verge of collapse, but that there had been a deep and significant shift in market perceptions of the crisis, and that this shift required a new and much more fundamental response from Europe's leaders and institutions. It is the capacity of these leaders to agree on even the broad outlines of a viable and effective response which is at the heart of all the market nervousness, and in this sense the recent decision by the rating agency Standard and Poor's to lower downgrade the US sovereign has only served to complicate further an already complicated situation.

So why this abrupt and dramatic change in the way the game is being played? Undoubtedly the lion’s share of the explanation is to be found in the arrival of a new, and to many unexpected, elephant in salons of European power. With something like 1.9 trillion Euros in outstanding debt, Italy is the planet's third largest issuer of sovereign bonds (following Japan and the United States) and although the relatively high savings rate of the Italian private sector (both families and corporates) means that much of the debt is in Italian hands, the deep interlocking of Europe's financial system (which is a by-product of the deep and liquid bond markets which came into existence following the creation of the common currency) means that a considerable portion is not.

In a certain sense the Italian crisis has crept up on market participants and caught them unawares. The reason for the relative unexpectedness of the scale of Italy’s problems is in part historical accident (that it was Greece, and not say Ireland, that got into trouble first) and in part a reflection of the need for market discourse to find a single and unified focus, and in this case the focus was on deficit and not debt. To put it simply, all too often market discourse could be described as suffering from some kind of “one track mind” syndrome.

The high profile given to the Greek issue meant that to a large extent Europe’s problems were perceived as being fiscal deficit ones, with more fundamental issues like lack of convergence, current account imbalances, cumulative debt and low economic growth all being pushed well into the background. Now things have changed. As former UK Prime Minister Gordon Brown put it recently: “Now no number of weekend phone calls can solve what is a financial, macroeconomic and fiscal crisis rolled into one”. Solving the crisis involves “a radical restructuring of both Europe's banks and the euro, and will almost certainly require intervention by the G2O and the International Monetary Fund”.

Historic Issue With The Euro

Perceived by many as being ill-gotten and ill-born, the issue of Euro parentage has long been a topic of intense debate and controversy, most notably between economists on one side of the Atlantic and those on the other, and between micro- and macroeconomists. There simply has been no consensus on what in fact the problem is, and criticisms from the United States of the way the crisis has been handled in Europe are often felt to be unfair and misplaced. As ECB Executive Board Member Lorenzo Bini Smaghi put it in July speech to the Hellenic Foundation for European and Foreign Policy, in the United States a significant financial crisis does not call into question the whole institutional and political set-up, and the dollar itself is not considered to be at risk. In Europe, in contrast, a crisis is often considered by outside observers as putting the euro, and the Union itself, at risk of disintegration. “Academics and other experts deliberate on whether the euro area is viable and how it can be rescued. Closet eurosceptics suddenly reappear, dusting off their I-told-you-so commentaries”.

Whilst Mr Bini Smaghi undoubtedly puts his finger on the core of the issue in this statement, and most certainly reflects the level of frustration felt by key players in European decision making, analogies with individual states in the Union simply fail to get to the heart of the reason for much of the preoccupation. It is not simply a question of “closet” (or open) eurosceptics suddenly reappearing, but of the monetary union repeatedly showing fault lines exactly where many of those much berated macroeconomists had expected they might appear. This is why Mr Brown is undoubtedly right to focus on the fact that beyond an immediate fiscal crisis, what we have in Europe is also a crisis of macroeconomic management and of financial stability. As he so eloquently puts it, what many were worried about was the fact that the initial Euro design contained "no crisis-prevention or crisis-resolution mechanism and no line of accountability when things went wrong".

Naturally Gordon Brown is far from being the first to have voiced such views. The fact that economies in Europe’s core and those on the periphery far from having converged have actually been diverging under the watchful eye of ECB monetary policy has long been a cause for concern in macroeconomic circles. In particular, at the heart of the monetary union’s current problems lie the huge imbalances which have been generated between the economic “surplus” countries in the core, and the external deficit ones on the periphery. Europe’s leaders have long avoided biting the bullet, and indeed could be considered to be in deep denial, over the significance of this issue. Referring to the prevailing voices among European policymakers former IMF Chief Economist Simon Johnson put it this way:

“I vividly recall discussions with euro-zone authorities in 2007 — when I was chief economist at the I.M.F. — in which they argued that current-account imbalances within the euro zone had no meaning and were not the business of the I.M.F. Their argument was that the I.M.F. was not concerned with payment imbalances between the various American states (all, of course, using the dollar), and it should likewise back away from discussing the fact that some euro-zone countries, like Germany and the Netherlands, had large surpluses in their current accounts while Greece, Spain and others had big deficits”.

The fig-leaf of Europe’s nations being somehow equivalent to US states has long been held up to justify the idea that the common currency was in general working well, and that the problems involved in managing it were being greatly exaggerated. With the arrival of the Italian elephant onto the centre stage at a stroke this argument has become as outdated as the institutional structure which lay behind it, since few of core Europe’s leaders are really willing to accept the responsibility for giving full and lasting guarantees for the country, quite simply because it is not just one more state in a fully integrated union, but a sovereign nation with all that that implies.

Having said this, there can be no doubt that Europe’s leaders have made huge strides forward in their attempts to get to grips with the issues as they have presented themselves, even if the measures taken so far continue to fall woefully short of what will eventually be needed. As the crisis has moved on from the initial concerns about Greek accounting methods, the piecemeal approach adopted by European policymakers has lead them to erect what is now a veritable production line of crisis resolution instruments and departments, with each of the needy patients being situated at different stages of the treatment process. In the Greek case the underlying issue is now acknowledged to be a solvency one and teams of experts are hard at work in a seemingly endless struggle to try to decide just what degree of restructuring (and/or reprofiling) Greek debt will finally need. In the Irish and Portuguese cases the task still remains one of monitoring programme implementation, with the focus being on whether or not they will eventually require (Greek style) a second stage bailout package. Meanwhile in the antechamber, the Spaniards and the Italians patiently wait their turn, while the doctors and health system administrators hold a heated debate as to whether there is enough space available in the emergency ward, and whether the patients have sufficient insurance to cover them should the surgery need to be drastic.

Too Big To Fail (Or Save)

What now brings a renewed sense of urgency to the whole process is the question of whether Spanish and Italian bonds could soon find themselves shut out of the financing markets in the way their smaller predecessors were before them. The latest ECB decision to intervene in their bond markets would seem to make it more rather than less likely that they eventually will be, since it is hard to see how they can now move back to unsupported market prices.

One of the curious anomalies about how the debate is currently being framed is the way in which banks and money funds who have invested in Europe’s periphery are being told that it is only right they should now assume some part of the anticipated debt restructuring burden due to their earlier policies of “irresponsible lending”, while these very same investors are also being urged to purchase new issues of just this very debt, on the argument that risk is exaggerated since the countries concerned have essentially sound economies, and are only suffering from short term liquidity and balance of payment type problems.

The underlying dilemma for such institutions has been highlighted by the decision of the Italian market regulator Consob to request information on the recent move by Deutsche Bank to reduce its exposure to Italian government debt. Banks have some responsibility to their clients, and will not normally knowingly take decisions which will lose money for them. So it is only rational for them to try to “lighten up” their positions on some of Europe’s weaker sovereigns. What isn’t credible is for political leaders to at one and the same time tell the banks that they are lending irresponsibly and urge them to purchase debt which may well end up being restructured. Thus the recent insistence on private sector involvement in Greek restructuring is often not unnaturally seen as one of the triggers for financial institution flight from Spanish and Italian bonds.