Spain Real Time Data Charts

Friday, May 30, 2008

Spain Retail Sales April 2008

Spain Inflation and Producer Prices May 2008 (Flash Estimate)

Consumer Inflation

The HICP annual inflation is expected to be 4.7% in May 2008, according to the flash estimated issued by the INE. This index provides a preview of the HICP that, if confirmed, would imply a five-tenths increase on the annual rate, since in April this change was 4.2%. The INE issues this indicator with the aim of incorporating it into the calculation of the HICP flash estimated of the European Monetary Union (EMU) published by Eurostat. Obtaining this EMU flash estimated forms part of the Eurostat and European Central Bank policy of offering timely and quality data that is comparable with that produced by the United States.

Producer Prices

In April, the Spanish Producer Price Index registered a 0.8% increase with respect to the month of March 2008 and an increase of 7.2% with respect to April 2007. The activities that most influenced this variation were Manufacture of coke and refined petroleum products (28.8%) and Food and beverage products industry (10.5%). By economic destination of the goods, the variation rates as compared with the same month the previous year were 5.3% for consumer goods (3.2% for durable consumer goods and 5.5% for non-durable consumer goods), 2.2% for capital goods, 6.0% for intermediate goods and 16.5% for energy.

Wednesday, May 28, 2008

Spain Mortgages March 2008

During the month of March the average amount per mortgage constituted was 164,637 euros, 1.5% more than for the same month in 2007 and 2.8% lower than that recorded in February 2008. In the case of mortgages constituted for housing, the average amount was 141,725 euros, 3.8% less than the same month in 2007, and 4.9% lower than the figure registered in February 2008.

97.9% of the mortgages constituted in March used a variable interest rate, as opposed to the 2.1% that used a fixed rate. Within the variables, the Euribor was the reference interest rate most used in constituting mortgages, specifically in 86.8% of new contracts.

The average value of the mortgages signed in March increased by 1.5% on a year on year basis and reached 164,637 euros. The number of mortgages changing conditions increased by 1.6% and registered cancellations decreased by 33.8%.

Wednesday, May 14, 2008

Spain GDP Q1 2008 Preliminary

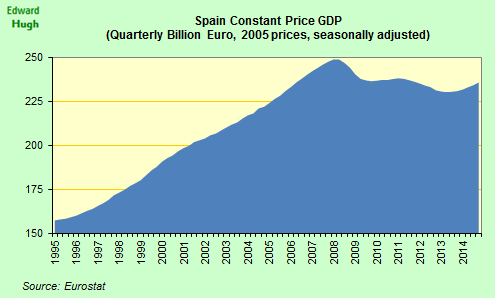

Moreover, the quarter-on-quarter GDP growth rate was 0.3%, five tenths less than the 0.8% achieved in the previous quarter.

As can be seen from the quarterly growth chart the Spainsh economy most probably peaked in the last quarter of 2006. The economy then slowed gradually for three quarters, and then we hit the financial turmoil of August 2007, and the probles in selling cedulas, after which point the Spanish economy simply went into "nose dive" if present trends continue (and there is no reason whatsoever for thinking they won't) then I think we have a 50% possibility of q-o-q negative growth in Q2, and a virtual certainty of negative q-o-q in Q3. In other words the Spanish economy is at best two quarters, and at worst one quarter away from outright recession at this point.

Which means we can expect a maximum growth of less the 1% for GDP in full year 2008, and probably much less, with the emphasis on much.

On 21 May the INE will publish the complete tables and charts of the Quarterly Spanish National Accounts for the first quarter of 2008.

Update 15 May 2008

The Financial Times have an article this morning from Leslie Crawford (Madrid) and Frank Atkins (Frankfurt) on the Spanish slowdown. They have most of the picture, although they probably still underestimate the depth of the present problem. Also they say this about Germany:

Nevertheless, Spaniards can draw comfort from the fact that growth in northern Europe is proving to be more resilient. Stronger-than-expected growth in Germany and France is good news for Spanish exporters, who rely heavily on northern Europe for orders.

The sharp slowdown in Spain contrasts with the much more upbeat data expected today from Germany. GDP in Europe’s largest economy grew at a significantly faster pace in the first quarter than the 0.3 per cent growth seen in the final three months of last year, according to analysts’ estimates.

I think this, while all being true is rather misleading, since Germany is now evidently itself slowing (and part of the explanation is probably the reduction in exports to Spain and Italy), so if we look forward to the second or third quarter it seems pretty clear that Germany will itself be having a slowdown (a slowdown, not a housing crash), and while this will likely be more moderate than Spain, it won't be a plus for Spain as the authors suggest. Latin America is a much more likely potential plus, but this is probably rather in the longer term.

Otherwise, as I say, the FT more or less have a fair summary of the game so far:

The brusque slowdown appears to have caught the recently re-elected Socialist government by surprise – even though Spain’s biggest business lobby, the Círculo de Empresarios, warned last month about the risks of stagflation, a period of little or no growth with high inflation.

Pedro Solbes, finance minister, recently lowered the official growth estimate for 2008 from 3.1 per cent to 2.3 per cent – but on the basis of the economy’s recent performance, the new forecast looks optimistic.

Mr Solbes, in Brussels yesterday for a meeting of European finance ministers, would only confirm that the economy was “decelerating rapidly”.

Economists worry about the impact of the slowdown on employment and on government revenues. Spain has a fiscal surplus of about €20bn – two per cent of GDP- which Mr Solbes says he will spend to keep the economy afloat. Revenue collection in the first months of the year, however, have been below expectations.

Between 2004 and 2006, Spain created one-third of all the new jobs in the EU, many of which were filled by Spain’s 4.5m immigrants – 10 per cent of the total population.

Unemployment is now rising as the labour-intensive construction and services industries shed tens of thousands of jobs. Last month, unemployment topped 2.3m – 15 per cent higher than a year ago. Job creation in Spain stops when growth dips below 2 per cent a year, economists say.

The slowdown is hitting immigrant workers particularly hard, and Celestino Carbacho, the new labour and immigration minister, is understood to be considering voluntary repatriation schemes for unemployed foreigners who wish to draw Spanish unemployment benefit in their home countries. The Spanish government says it would also support the returnees with small loans to start up businesses. However, similar schemes have attracted only a handful of volunteers in the past.

Spain Industrial Output March 2008

Unadjusted industrial output dropped 13.3 percent in March from a year earlier.

Wednesday, May 07, 2008

Spain Unemployment April 2008

246,000 more people were classified as unemployed in the first quarter than a year earlier, and this is the third consecutive quarter in which the country's jobless rate has risen. Spain's service sector fuelled most of the losses, with 77,500 redundancies, closely followed by construction.

Finance minister Pedro Solbes told a press conference that he predicted unemployment would rise to 9.8 per cent this year and ten per cent the next. He also said he expects the Spanish economy to generate 200,000 jobs in both 2008 and 2009, although he didn't really elaborate in any detail on how he expects this target to be achieved, and it looks not only too optimistic but also completely unreal in the light of the crisis which is emerging.

Official unemployment figures realeased INEM were up by 37,542 in April, a month which is usually good for employment growth. This is the first time since 1996 that unemployment has risen between March and April. According to INEM there are now 2,338,517 registered unemployed in Spain.

In fact unemployment has risen by 315,393 (15.59%) over the last twelve months. Last year unemployment dropped by 36,327 in April which is almost the same number that it has risen this year.

The highest month on month rise in unemployed was among men with 28,230 more unemployed (2.9%) being added in April, while in comparison unemployment among female workers only rose by 9,312 (0.7%). At the end of April the total number of unemployed men was 996,715 and the total number of unemployed women was 1,341,802.

Year on year and when compared to April 2007 male unemployment is up by 30% and female unemployment by 6.7%.

Unemployment among the under 25 year olds has risen by 6,852 which is 2.5% more than in March.

Tuesday, May 06, 2008

Spain Services PMI April 2008

The RBS/NTC Eurozone Services Business Activity Index rose from 51.6 in March to 52.0 in April, coming in slightly above the earlier flash estimate of 51.8. However, the rise still indicated only a very modest acceleration in growth, with the rate of increase remaining weak by historical standards of the survey (and only slightly above the average reading for Q1, which had been the weakest quarter since Q2 2003).

Spain

Spain's service businesses cut jobs in April at the fastest pace in the near nine-year history of an NTC survey of the sector as demand contracted for the sixth month running, data from NTC showed. In the wake of a Bank of Spain forecast that economic growth slowed to 2.8 percent in the first quarter from 3.5 percent in the final quarter of 2007, the PMI survey showed both activity and new orders fell sharply, although the slide was slightly less pronounced that a month ago.

The headline index for the sector edged up to 42.5 in April from 40.9 in March, while the new business index was unchanged from March's survey low of 40.2, its sixth month below the 50 divide between growth and contraction.

Chris Williamson, chief economist at NTC Economics, said the survey showed that Spain's downturn had expanded well beyond the property sector -- the engine for a decade of Spanish growth which is now running out of steam. "It looks like there's a broad-based downturn occurring here, and there's evidence to suggest that's going to continue in the coming months," Williamson said.

Only two sectors of the six sectors surveyed -- business-to-business services and IT -- showed any growth at all, said Williamson.

"All sectors exposed to the consumer are having a hard time, which suggests that basing forecasts on weakness confined to property and construction is being rather hopeful."

Official data last month showed the unemployment rate jumped in the first quarter to a 3-year high of 9.6 percent and NTC said that based on the PMI survey, that would rise further in the second quarter. The PMI showed the sharpest decline in employment in the sector since the survey began in August 1999 as companies adapted to reduced workloads. Optimism also hit a survey low, for the third month running, although more than one third of those surveyed thought business would pick up in the next year.

Monday, May 05, 2008

Spain Consumer Confidence and EU Economic Sentiment Indicator April 2008

The index measuring the perception of the current economic situation slipped to 51.8 in April from 60.0 in March, and confidence in expectations for the next six months fell to 75.9 from 86.2. Employment expectations fell to to 48.5 from 57.5 last month.

'In April, sentiment data fell again mainly due to drops in the components that relate to the Spanish economy and employment,' ICO said. 'The drop seems to point to a faster deceleration in family consumption than was expected at the beginning of 2008...and is in line with forecast cuts for Spain's GDP and private consumption growth.'

PNB Paribas in a research report out today note that:

Household confidence collapsed further in Spain, falling 9.3 points over a month and 30.6 points over a year to 63.8 in April according to ICO. This is the lowest level ever, but the index only started in September 2004. The fact that the absolute level is way below the neutral threshold of 100 is more meaningful.

This is not a real surprise given most indicators are plunging in Spain. The soaring prices and rising unemployment naturally weigh on household confidence. Today's data also confirmed that house prices are on the decline, which can only make things worse for this country. The pace of the decline registered in April is quick, which darkens the outlook for Q2 growth, making unlikely the fact that the 0.4% q/q growth registered in Q1 would be repeated in Q2, as we said last week.

This general picture is also confirmed by the April reading on the European Commission’s eurozone “economic sentiment” index which fell sharply from 99.6 in March to 97.1 in April – the lowest level since August 2005. With the indicator regarded as good guide to growth trends, the unexpectedly steep decline pointed to a marked deceleration in economic activity.

Still, eurozone countries show varying performances. Economic sentiment in Spain, which is at risk of a serious house price correction, has fallen to the lowest level since late 1993. But sentiment in Germany and France remains relatively robust – falling to the lowest levels since February 2006 and December 2005 respectively.

As can be seen from the above chart, Italy continues - like Venice - its steady downward drift, while the two eurozone economies which had the strongest housing booms head steadilyoff the cliff, with Spain having poll position, and by quite a long margin.

If we look back to the previous ICO consumer confidence charts we can see really that the downward process slowed in February March - coincidentally or not this was the election period - but the downward fall in expectations has now taken an additional lurch entering April. This coincidees with the general idea that the problems in the financial and construction sectors - which have to some extent had a torniquet applied to them by action at the ECB (in accepting cedulas) and by the continuing acceptance by the banking sector of the builders growing indebtedness - are now slowly but steadily (rather like an oil slick in the ocean) extending their way across and into the real economy.

This picture is also confirmed by the most recent employment data and by the April manufacturing PMI (see seperate posts).

Sunday, May 04, 2008

Spain Retail Sales March 2008

Foodstuffs increased 5.1%, while non-food products decreased 11.2%. A breakdown of the latter by type of product showed the following rates: -6.0% for Personal Goods, -17.1% in Furniture and household equipment and -8.2% in Other goods.

Breaking down the general retail sector index according to the different means of distribution we find that large chain stores recorded the lowest negative interannual rate at constant prices (- 2.4%), followed by department stores (-7.8%). In contrast, companies with a single outlet and small chain stores recorded a more pronounced decrease in retail sales as compared with the previous year at constant terms, with rates of - 11.2% and –11.4%, respectively.

Saturday, May 03, 2008

Spain Manufacturing PMI April 2008

The final RBS/NTC Eurozone Manufacturing PMI came in at 50.7 in April, down from 52.0 in March and slightly below the earlier flash estimate of 50.8. The fall in the PMI was the largest for six months and took the index to its lowest since August 2005.

National trends among the big-four euro nations varied markedly again in April, as did production by sector, with consumer goods producers reporting a survey record decline in output.

The PMI (Purchasing Managers' Index) was particularly weak, registering the first decline in new orders since May 2005 (in line with the flash reading). New export orders fell by marginally more than indicated by the flash reading, also declining for the first time since May 2005 due to softer economic growth in key foreign markets and the strong euro.

Among the big-four euro countries, only Germany recorded an increase in new orders, though the rise was the smallest for three months. This deterioration was primarily the result of a substantial easing in growth of new export orders at German manufacturers. Spain and Italy both saw new orders fall at the steepest rates since December 2001.

In a sign of broad-based weakness of production to come in future months, new orders for consumer, intermediate and investment goods (such as plant and machinery) all fell in April, albeit only marginally in the case of investment goods. Consumer goods producers saw the sharpest monthly drop in new orders in the survey’s ten-year history, in part reflecting lower levels of new export orders.

Spain

Spain's manufacturing sector shrank at its fastest rate in more than six years in April and more hardship seems to be on its way as orders continued to dry up. Spanish economic growth is expected to halve this year from last year's rate of 3.8 percent as property sales plunge, the construction sector shrinks, loan defaults rise, and unemployment surges.

The NTC Purchasing Managers Index (PMI) showed the gloom had settled firmly over the manufacturing sector which shrank for the third month in a row, dropping from 46.4 in March to 45.2 in April, its lowest in 76 months and well below the 50-mark that separates growth and contraction.

The new orders index dropped to 42.0 from 45.3, which NTC put down to weaker demand from the building sector and foreign buyers put off by the strength of the euro. Export orders dropped at the fastest rate in almost five years.

"The continuing strength of the euro and worsening global economic conditions suggest external demand is unlikely to fill the void left by the end of the construction boom." said Nathan Carroll, an economist at NTC.

Employment slipped for the eighth month running and at the sharpest rate for three years at 47.7 as manufacturers tried to cut costs and make up for lower orders.

That might put in doubt government predictions that industry can provide new jobs for those who have been laid off from the construction sector.

"I suspect that these numbers will provide some worrying reading for anyone thinking that the manufacturing sector can absorb jobs from construction ... employment is falling for the eighth month running and the indications are that companies are going to cut back further," said Chris Williamson, chief economist at NTC. "The long term trend in employment is difficult to say ... but would we expect to be seeing job losses in industry in the INE survey in coming quarters? Yes."