Q4 Contraction Confirmed

Well first off, and it doesn't really come as any surprise, the Economy Minstry confirmed earlier this week that on their estimates Spain's economy contracted during the fourth quarter (not exactly any kind of surprise this), but it did more or less bring the agony of waiting to an end, and the country's first recession in 15 years (the last one ended in 1993) is now just about as official as it is likely to get.

The Ministry felt able to say this because their Indice Sintético de Actividad (or synthetic activity indicator -ISA), which uses a number of proxy variables to try to track Spanish GDP, contracted by 1.5 percent (year on year rate, we still have no idea of the q-o-q rate) between October and December. (You can find an ISA table with text in Spanish here).

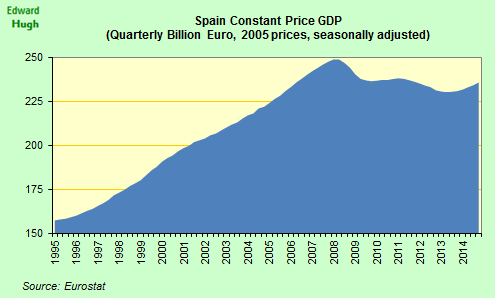

This is of course Spain's second consecutive quarter of shrinking growth (I can't imagine there is anyone in Spain who doesn't actually know this already), following a quarter-on-quarter GDP contraction of 0.2 percent between July and September. It is worth bearing in mind, however, that this is only a very approximate indicator, and it doesn't seem to track the final result very closely at all if you look at the actually chart. So I think we need to wait for a more accurate reading which will only be given to us when Spain's INE releases preliminary fourth quarter GDP data on February 12, although a pretty good approximation will be available in the Bank of Spain bulletin to be published at the end of January. Anyway, for what it is worth, here (see below) is what the year on year growth chart would look like if the 1.5% number was anywhere near reality. Pretty horrid, isn't it? I don't think we should assume it will be this bad, but the number we really need to see is the seasonally adjusted quarter-on-quarter one, since that will tell us just how rapidly Spain's economy was contracting during the quarter, and tell us more or less where we are at this point. The contraction was pretty fast would be my guess, maybe 1% or even more, given the very strong data we have been seeing recently.

Bank Credit Continues At A Pretty Low Level

“There is a burgeoning economic crisis in the European periphery,” Krugman said on the ABC network Dec. 14. “The money has dried up. That’s the new center, the center of this crisis has moved from the U.S. housing market to the European periphery.”

We now have Bank of Spain data for bank lending to households and companies in October, and while the numbers look considerably better than those for August and September, the improvement is only relative, and there is still a pretty strong credit crunch going on out there. I don't know whether or not Krugman has Spain in mind when he spoke of the European preiphery (he almost certainly was referring to the situation in Eastern Europe), but if he did, he wouldn't have been far wrong. As we can see from the chart below, the banks had been struggling to find money for household lending right through the first half of the year, but after July the position really went straight off the map, and even though, as I say, the October number picks up, it still shows lending running at a very low level.

Lending to corporates has kept up better than lending to households (another way of looking at this would be to say that the mountain of debt has just kept on growing, and that the need to support the walking dead has been one of the reasons so little of the available cash has been finding its way through to end consumption), but it is still falling steadily in year on year terms.

Are The Cracks Now Appearing In The Spanish Administration's "If It Moves Deny It Exists" Approach?

Bank of Spain governor Miguel Angel Fernandez Ordoñez walked into the headlines last Sunday by issuing a bleak assessment of the current economic crisis, even going so far as to warn that the world could face a "total" financial meltdown - something he stressed had been unseen since the Great Depression. I am sure the danger of even more things going wrong is out there, and is real, but personally I found Ordoñez's comments a little exaggerated - or at least not really in keeping with the kind of sobre and measured evaluation of events you expect from a central banker, and not exactly in line with the "good housekeeping has meant that Spanish banks don't have a problem" approach he has been serving up since August 2007. I mean, if we are simply talking about the financial dimension of this crisis, well the worst may well now be over in many of the world's major economies, although this is not the same thing at all as saying that the worst of the impact on the real economy is over, indeed as I explain in this post, that part is only just begining.

Indeed, (again as I explain in this post), this was precisely the pattern we saw in the Great Depression, when a very serious financial crisis in 1929 and 1930 was followed by a serious contraction in economic output from 1930-33, and then by a very slow recovery from 1934 till WWII. Unfortunately we may now repeat some of that pattern again (from a lot richer starting point, of course), with a serious financial crisis in 2007/08, and then an economic slump from 2008 to 2010. Even worse, there are reasons for thinking that even then the recovery may again be a slow one, since with everyone trying to deleverage, and move from being net consumers to net exporters, we end up being left with that tricky little question of just who is going to do the consuming, and who is going to buy all those exports. Anyway, at this point I think we could usefully leave that rather theoretical topic for the future, and focus a bit more on the coming recession, since if we don't manage to focus on it, it will darn sure focus on us.

So, as I say, Ordoñez does seem to be a bit exaggerated in his choice of words, unless...... unless what he really had in mind was not a generalised financial meltdown, but a meltdown in a number of key countries (Krugman's European preiphery), and even more specifically in this case, a meltdown in Spain. This I think is a much more credible explanation, and methinks that what he was actually doing was using politically acceptable code language to talk about Spain (since no one ever seems to actually say what they really think here at the present time - you know, "a mal tiempo, buena cara").

Some support for this interpretation can be found in the most recent Economist Intelligence Unit country summary on Spain - bemusingly entitled Spain economy: In need of support. I say bemusingly, since they don't make clear whether the support Spain's economy needs should come from the national government, or whether the issue is now so large that such support will have to come from outside (which is my own personal view). Anyway, the EIU do draw our attention to one possible explanation for the Bank of Spain Governor's recent outburst, and that is that the Spanish administration is now a house divided unto itself. That is, there are quarreling factions.

One consequence of the recent policy measures is the emergence of two discernable factions among the country's leading policymakers. On the one hand, Mr Zapatero favours a strongly expansive fiscal response and hands-on public-sector engagement in the real economy—an approach that is backed by the increasingly influential minister of industry, commerce and tourism, Miguel Sebastián.Well basically all of this makes a lot of sense to me, and I have been picking up in earlier posts here on just how the Bank Governor has been trying to draw attention to the way that deficit spending was getting out of hand. Indeed, I myself have been expressing exactly these kind of concerns here on this blog. Now let's be clear, the problem is not that Spain is running a fiscal deficit at this point, nor even that this deficit is likely to exceed the EU 3% of GDP limit. Exceptional circumstances demand exceptional measures, and obviously we need quite a strong fiscally-driven injection of some kind at this point - the issue rather is that the Spanish government need to think very carefully about what they are doing with the money they are raising and spending. If they spend the money on more and more construction activity, on the basically eroneous assumption that this is simply a cyclical rather than a structural crisis, then they will simply make things worse in the longer run, since they are using up badly needed ammunition.

In the opposite corner the minister of the economy, Mr Solbes, and the governor of the Bank of Spain (the central bank), Miguel Ángel Fernández Ordóñez, are both displaying visible concern about the consequences of unbridled fiscal expansion and the public appropriation of private risk. Mr Solbes recently spoke of the dangers of an excessive deficit, while Mr Ordóñez has warned the government that it runs the risk of leaving itself with no room for manoeuvre if the economy continues to deteriorate for a protractedperiod.

"The lack of confidence is total," Miguel Angel Fernandez Ordonez said in an

interview with Spain's El Pais daily. "The inter-bank (lending) market is not

functioning and this is generating vicious cycles: consumers are not consuming,

businessmen are not taking on workers, investors are not investing and the banks

are not lending. "There is an almost total paralysis from which no-one is

escaping,"

I think Ordoñez is talking about Spain here (and possibly the UK, and Ireland, maybe Italy... but not France, and not Germany, where despite serious problems the issues are different). Ordoñez also added that any recovery, which the "optimists" (read Zapatero and Sebastian) are pencilling-in for the end of 2009 and the start of 2010, could well be delayed if confidence is not restored. I wholeheartedly agree, and indeed I have the most serious part of the Spanish crisis "pencilled in" for 2010/11 - if the car makes it that far without one of the pistons seizing up that is.

The Straw That Broke The Camel's Back?

Ordoñez also suggested that the European Central Bank, of which he is a governing council member, would probably cut interest rates in January if inflation expectations went much below two percent. "If, among other variables, we observe that inflation expectations go much below two percent, it's logical that we will lower rates." he said. This again was noteworthy, since ECB President Jean-Claude Trichet had been busy stressing, only a couple of days earlier, that there was a limit to just how far the central bank could cut rates, even going as far as to suggest that in his opinion the bank might decide to pause in January, despite the fact that even the bank's own forecast indicates that the entire eurozone economy will contract in 2009.

Ordoñex also made plain that in the event “expectations of deep deflation” should emerge in the Eurozone then he personally would be in favour of following the same policy of quantitative easing the Federal Reserve has deployed, cutting in the process the target lending rate to near zero.But this simply begs the question, what does the ECB do if deep deflation expectations develop in some countries and not others?

He also said he thought that credit growth would probably match nominal gross domestic product growth next year, which is interesting, since if we do get deflation in Spain, nominal GDP will fall, and this would seem to imply that bank credit might even fall. As we have seen above, on a year on year basic credit is still growing faster than gross domestic product, but it is slowing continuously, and over the last four months has hardly moved.

Tourism Hit From Britain

Of course, at this point in the game events in one country have an impact on events in another, and Spain is especially vulnerable here due to the strong dependence on external tourism. Arrivals of foreign tourists to Spain were sharply down in November as Britons and Germans increasingly worried by their own internal situation (and the falling pound) stayed at home in increasing numbers. Total arrivals were down 11.6 percent over November 2007, with tourism from Britain down 15 percent, according to data last week from Spain's Industry, Tourism and Trade Ministry.

Tourism is Spain's second biggest industry and leading destinations Catalonia and the Balearic Islands suffered falls of over 10 percent in November. Foreign tourist arrivals were down an annual 2 percent - to 54.6 million - in the 11 months from January to November.

Bankruptcies On The Rise

Over 1000 Spanish property and building firms have filed for bankruptcy protection in 2008 and more than 1300 could follow in their footsteps next year (as they struggle to repay an estimated 470 billion euros in debt), according to the latest report from Price Waterhouse Coopers. Analysts at Credit Suisse (in a separate report) estimate that the non-performing loan rate will rise to 9 percent by 2010, up from the current 3.5 percent at present, threatening the solvency of the regional savings banks that hold over half of all property debt.

Of course in all of this it is important to realise that most of the numbers are just guesstimates, but the 470 billion euro in debt attributed in the press to LSE economist Luis Garicano t (315 billion in developer loans and 160 billion in builder loans) seems firmly rooted in Bank of Spain data, and this quantity is enormous.

In 2008 alone, the Spanish banks have had to swallow around 15 billion euros of bad loans from builders, lentfirms 5 billion for assets to stave off bankruptcies, and taken on board another 5 billion in debt-for-equity deals, according to the newspaper El Mundo. Credit Suisse take the view that bad loans at larger, publicly traded banks like Santander and BBVA should remain at manageable levels around 4 percent, but they suggest that some regional savings banks, with higher property exposure, could see rates of 12 or 13 percent in two years and face capital shortages.

Asked whether Spanish lenders would need recapitalizing, the central banker said

this “depends on one’s hypothesis.” Spanish banks are facing difficult years

ahead, and some institutions will merge, he said. Still, regular banks are less

fragmented than Spain’s savings banks, which are tied to autonomous regions and

channel profits to social projects, Ordonez told the newspaper El Pais.

“Logically, if results fall, mergers are very possible,” he is cited as saying.

“Common sense indicates there will be mergers.”

House Prices Falling - But How Far And How Fast?

One of the biggest mysteries about what is actually happening in Spain concerns Spanish property prices, which if you accept the figures published by the Spanish housing ministry have barely fallen so far (down just 0.5% in 2008). No one really accepts this number as "good", but there is little real consensus at this point about what a more accurate figure would be, or what we can expect in the future. A number of banks have now expressed an opinion, most recently Spain's very own BBVA, who now estimate prices will fall “close to 5% in 2009 and 10% in 2010" leading to a total fall of 25% by 2011. They thus joinn the Swiss banks Credit Suisse and UBS who have already forecast a drop of 30% over a similar time frame. For my own part I think there are so many unknowns at this point that all estimates must surely be of a rather symbolic nature. All I think that we can say is that the drop is going to be large and substantial.

BBVA also dip their toes in the water by offering an estimate of the size of the inventory of new homes languishing on the market. They put this number at anywahere between 800,000 and 1.4 million, rather above the Ministry of Housing’s current estimate of 650,000 unsold new homes. Neither BBVA nor the Ministry offer figures for the number of resale properties on the market. BBVA also estimates that housing starts will drop to 200,000 per year, down from more than 800,000 in recent years.

This does not seem an unreasonable suggestion, and housing starts in the province of Barcelona have fallen dramatically recently - according to the Catalan College of Architects - down by 83% year on year in October, with just 646 new residential construction projects being started, compared with 3,792 in October 2007. The slowdown in housing starts even seems to be accelerating, since the drop in the first 10 months of the year was 64.5%. Construction was down for all types of property, with flats falling 84%, semi-detached properties down 91%, and villas down 65%.

On the other hand many developers are still working to finish homes which were first set in motion during the boom years, and in the first 10 months 2008, incredibly they finished 12% more homes than last year, though again construction completions have started to fall as the year has advanced, with October completions down 33% compared to last year.

And the dramtic drop in new building starts isn't simply restricted to Barcelona, with new starts in the province of Alicante (Costa Blanca) falling to the lowest level ever recorded, according to reports the Spanish press. The number of residential construction licences issued in Alicante has fallen to just 720 in 2008 from 4,165 in 2007. The previous record low for building permits in Alicante was in 1996, when just under 2,000 licences were granted, almost triple the amount this year. The record high was 2003, when close to 4,500 construction licences were issued.

All of this simply confirms the estimate of José Luis Malo de Molina, head of research at the Bank of Spain, who stated that building completions in Spain in 2008 would be an all time record - beating even last year’s previous high of 641,419 completed properties, but that then the fall of the cliff would be absolutely brutal, with developers forecasting just 150,000 housing starts next year, compared to 250,000 this year, and more than 600,000 last year.

And to cap all this of, Spain's Association of Property Experts (REI) announced recently that resale property transactions in 2008 are down 70% on 2005, a “much bigger fall than is reflected in the official figures from the Ministry of Housing,”, according to REI, since the Ministry of Housing includes inheritances and gifts as ‘transactions’ in the total figure.

More Debt Purchases

The Spanish government is going back to the (reverse) auctions next month, will buy up to 4 billion euros worth of assets from banks on 15 January and up to another 6 billion euros in a second auction on 30 January. These purchases will be added to the two previous ones - on 11 December 11 the government bought 7.2 billion euros in mortgage-backed debt from 31 banks and on 20 November it acquired 2.1 billion euros in debt from 23 banks. The purchases will be made by Spain's Fund for Acquiring Financial Assets, which was set up to provide an alternative market for banks to issue long-term debt. Spain plans to buy up to 50 billion euros in bank assets over the next twelve months.

Immigrants Making The News

Immigrants have increasingly been making the news in Spain, and the eye of the press has been caught in recent days by Ubeda, a small Spanish market town in the heart of the olive-growing region of Andalucía. What has been attracting attention is the presence of unusually large numbers (hundreds) of unemployed Africans waiting on street corners, hoping someone will turn up and offer them work . The pressure is such that Ubeda’s indoor sports centre has been converted each into a giant temporary dormitory to offer some kind of shelter to the homeless Africans.

Such migrants have now been arriving in Spain's olive growing regions for years, but never in the present numbers or with so little chance of finding a job, according to local officials. The general impression is that the towns and villages of Jaén province have been flooded with thousands of destitute jobseekers in need of food and shelter. On the busiest night so far this year Caritas, the charitable arm of the Catholic church, fed something like 700 hungry immigrant jobseekers, and this in a town whose total population is 34,000.

The migrants – most of whom are from Senegal and Gambia, although there are some from Algeria and Morocco and a few from Romania and Bulgaria – are hoping that a jefe, or farm boss, will drive past in a van or a tractor, and offer an olive harvesting job that will often pay something in the region of 46 euros per day. Basically there are more migrants than ever looking for such work this year, while the number of jobs on offer is down since Spanish workers who previously shunned farm jobs are beginning to accept any work they can get and are often given preference by Spanish employers.

There are roughly 5 million immigrants in Spain, and they make up about 10% of the population, the highest proportion in the European Union. Even more strikingly, more than 4 million of these immigrants came to Spain after 2000, during the good years of the housing boom, they filled the toughest and worst paid jobs on building sites and farms. The connection with the housing bubble is evident. But now these workers are losing their jobs at twice as fast as Spanish born citizens, with unemployment already around 3 million and rising rapidly. The future of this population is one of the topics I will follow on this blog, since they are evidently among the most vulnerable, and the most exposed to the crisis.