"British or German taxpayers cannot finance the failures of others," German Economy Minister Rainer Bruederle said at the World Economic Forum in Davos, Switzerland, according to the Associated Press. "Solidarity also means everybody adheres to common rules."

France is not working with Germany or other countries on a support package for Greece which is managing to handle its problems on its own, a French government source said on Thursday. "I am not aware of a support plan. There is not a plan. We're not discussing one (with Germany or others)," the source told Reuters. "They are managing themselves. They are finding financing support on the market. There is no plan for a support plan. We are not working on one. Le Monde newspaper said earlier that euro zone countries were studying ways of helping Greece resolve its budget problems."

The above statements have been widely interpreted in the international press as a "no" from Germany and France to any EU bailout of Greece. But is this interpretation justified? Before going further, I think it should be pointed out that the whole argument depends on what you consider a bailout to be. If you take the view that a bailout involves a restructuring of Greek Sovereign Debt, with the EU itself offering to pay a part, then this is clearly not on the cards, at least at this point, and let's take things a day at a time. But if you consider the "bailout" which is under consideration at the present time to be simply a loan, which in some way shape or form (yet to be determined) would be guaranteed by the EU institutionally, and would thus be available at a cheaper rate of interest than the one the markets are currently charging, then it is hard to see how British or German taxpayers would be having to finance anything, except in the unikely event that Greece were unable to repay (as Moody's point out, Greece's problems are longer term, not short term), and remember, even Latvia and Hungary are likely to repay the loans already made to them, and their underlying economic situation (and competitiveness problem) is a lot worse than that of Greece. So basically the German economy minister is making a speech which generates good headlines, and political enthusiasm, but like Jüergen Starks before him, has little real significance in terms of the options which are really on the table.

On the other hand, statements like the following:

European officials on Friday sought to quell rumors of a pending bailout for Greece, insisting that the financially troubled nation could still manage to avoid a debt crisis on its own. The effort to allay market speculation came as investor confidence in Greek bonds fell this week to levels not seen in a decade, amid concern over the government's ability to close its gaping budget deficit and maintain financial stability.

Can simply be seen as officials doing the job they are paid to do, that is talk down the market pressure. Obviously, if the spread on Greek bonds could be talked back down, then there would be no need for anyone else to make a loan, but at this point in time, and especially following the ill fated proposal of Finance Minister Papconstantinou to mount a fund raising roadshow including a visit to China, this possibility looks very unlikely. After all, why should the Chinese banks risk their money buying bonds the German taxpayer is unwilling to buy? As Yu Yongding, a former adviser to the Chinese central bank said, it just isn't interesting to buy a “large chunk” of Greek government debt in order to help rescue the country simply because their securities "are more risky than U.S. Treasuries". “Let European governments and the European Central Bank rescue Greece", he said. Over to you Herr Bruederle.

And despite the fact that Joaquin Almunia strenuously denied in Davos that any kind of plan "B" existed, really they would be fools not to have a plan "B", and the people involved obviously aren't fools, ergo....

A top European Union official said on Friday there was no risk that Greece would default or leave the euro zone and the country's finance minister said he was not aware of any bailout talks. "No, Greece will not default. Please. In the euro area, the default does not exist because with a single currency the possibility to get funding in your own currency is much bigger," Monetary Affairs Commissioner Joaquin Almunia told Bloomberg TV. "There is no bailout problems."

Asked if its problems could force Greece out of the euro zone, Almunia said: "no chance. Because it is crazy to try to solve the problems the Greek economy has outside the euro zone," he said. Almunia said euro zone ministers had prepared fiscal recommendations for Greece and other countries, to be discussed at a regular meeting at European Commission level next week, but denied there was any special EU plan to rescue Greece. "It is a normal analytical document that is written every month," he said. "We have no plan B. Plan A is on the table. It is fiscal adjustment."

EU Commission "Ups the Ante"

So now lets turn to Plan A, and to that normal analytical document Señor Almunia refers to, which is due to be discussed by the Commission on Wednesday. Fortunately, the Greek web portal Ta Enea have seen the document, and Reuters have provided us with a convenient English language version of what they saw. What the Ta Enea report makes clear, is that the reason Greek Prime Minister Papandreou has not asked the EU for a "bailout loan" is connected to the conditions which would be attached to that loan. According to the reports, the EU Commission plan to go a lot further than simply providing short term funding on the cheap:

The European Union will tell Greece next week to take extra measures by May 15 to shore up its finances and cut a spiralling deficit, Greek newspaper Ta Nea said Saturday, citing a draft of the recommendations. The European Commission's recommendations, due to be made public on February 3, include cutting nominal wages in the public sector and setting a ceiling for high pensions, Ta Nea said.

Under the headline "Urgent measures to be taken by 15 May 2010," the EU document will tell Greece to "cut average nominal wages, including in central government, local governments, state agencies and other public institutions." The EU will also urge Greece to introduce advance tax payments for the self-employed and possibly a tax on luxury goods, according to the document, excerpts of which were printed by Ta Nea. Most other recommendations, as reported in the paper, are already part of the Greek plan.

Reports also mention putting a complete freeze on public sector hiring, and a system of monthly reports to the Commission along the lines of the Latvian programme. What this effectively amounts to is enforcing the implementation of an internal devaluation process along the lines of the ones adopted in Ireland and Latvia, as outlined in the most recent technical report to the commission (see here), in order to restore competitiveness to the economy and make Greek debt sustainable in the long run. It also amounts to an effective surrendering of part of Greece's national sovereignty to the EU Commission, and this is the part that virtually everyone is doubtless baulking at.

IMF Waiting On the Sidelines

Obviously, the EU Commission is not the only institution who could furbish the bailout loan, the IMF would serve just as well, and Marek Belka, Director of the IMF's European Office, has already made it very plain they are ready willing and able to help. And only last Friday John Lipsky, the first deputy managing director of the IMF, said the Fund "stands ready" to help Greece with its debt crisis. According to Lipsky's statement, the fund is in "ongoing contact" with the Greek authorities following a "scoping mission" to assess the possibilities.

"The IMF stands ready to support Greece in any way we can," Mr Lipsky said. "It is a matter for the Greek authorities to decide, in collaboration with the European Union, but we are here to help if we are wanted."

In fact, I personally favour the IMF alternative, given the time scale involved, and the likely programme implementation difficulties, and according to Edmund Conway, economics editor of the UK Daily Telegraph, this view is now shared by many "highly respected" economists:

I understand that in many of the conversations Mr Papandreou had [last week in Davos] with very senior, respected economists this week, he was directly advised to go to the IMF, which would be the 'cleanest solution'..... But an IMF intervention would have potentially to be channelled through European authorities, since Greece is a member of the euro.

But the EU Commission seems to have very strong reservations about going for the IMF route, which is why the "bitter pill" of the EU bailout loan may well need to be swallowed. My fear here is that EU reservations may mean that history sadly repeats itself, the first time in Latvia and then in Greece, as queasiness about taking on board the full implications of what is involved in correcting competitiveness distortions leads to policy-making delays and mistakes of the kind which in Latvia have produced a resession which is far deeper and longer than was actually needed, but which in Greece could easily lead to very serious problems for the entire Eurozone further on down the line.

Yet the door is certainly not closed on an IMF solution, and George Papaconstantinou did meet with IMF Managing Director Dominique Strauss-Kahn on Friday on the sidelines of the WEF in Davos. The possibility of IMF intervention was left open by IMF Managing Director Dominique Strauss-Kahn in an interview with broadcaster France 24 this weekend, although he certainly seemed to suggest that EU support was more likely. "We at the IMF are ready to intervene if asked, but that's not necessarily required," Strauss-Kahn said. "The European authorities, both in Brussels and the central bank, are looking at it and I think they'll handle it properly" ...."solidarity" within the countries sharing the euro could "fix the problem,", he said without elaborating.... "It's the first test of this kind for the euro zone,".

Contagion Danger Concentrating Minds

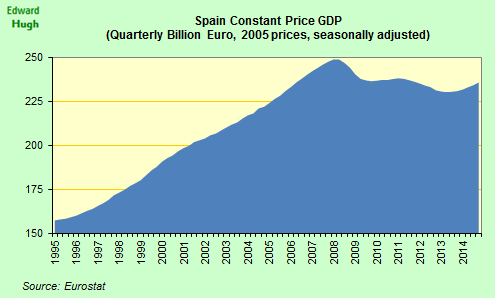

Perhaps the strongest argument to support the idea of imminent EU support is the level of contagion risk being experienced. Concerns that Athens may not be able to service its debt have put growing pressure on the euro, and even if some would welcome this as an aid to German export competitiveness, the attendent credibility issues hardly make the situation a desireable one. There are also growing worries that the Greek debt crisis could spill over to other weak members of the Eurogroup, such as Spain, Portugal, Ireland and Italy. The German daily Sueddeutsche Zeitung last week quoted an EU draft memorandum as saying the situation in Greece was creating a "big challenge and in the long term risky," and could force other euro-zone countries to pay higher risk premiums on their bonds. The spread between Portuguese and German 10-year government debt rose to 120.5 basis points on Friday - up from 114.9 the day before, and the spread on equivalent Spanish bonds is hovering round the 100 basis points mark. Basically, as one European leader after another stresses, it is hardly desireable to let Greece's problems lead other states to have to pay more to finance their borrowing.

Where's The Moral Hazard?

Finally, there has been considerable discussion about the dangers of moral hazard in the Greek case. If the EU offer a bailout loan, this will encourage other countries to seek something similar, so the argument goes.

"Moral hazard considerations suggest that the ECB will never openly support a bailout, but we doubt that Greece will be left on its own if the situation were to become critical," UniCredit analysts said. They referred to the danger that a rescue could reinforce ill-considered fiscal practices that have caused serious problems for Greece and others.

But if we look at the realities of the present situation, then it is clear that what is being offered to Greece in return for a possible loan is clearly not enticing, and indeed it may well be that countries would rather not accept the carrot in order to avoid the stick.

But there are other versions of moral hazard at work here. The FT's Martin Wolf put his finger on one of them:

At the same time, a bail-out by the eurozone as a whole would create a monstrous moral hazard for politicians. It would only be possible if the eurozone subsequently exercised a degree of direct control over the fiscal decisions of member states. It would, in short, be the fastest route to the political union that many initially believed was a necessary condition for success.

Indeed, the very creation of a monetary union in the absence of a political will for unification could be seen as having been the biggest moral hazard risk taken on board, and no matter how many clauses you put in Treaties beforehand, this risk cannot be avoided when push comes to shove.

But there is a third, and more dangerous version of moral hazard in play here, and this arises from the fact that the EU Commission may itself fail to adequately identify and diagnose the roots of the problem, with the result that the correction measures prove to be inadequate, sending Greek debt snowballing off into default. At this point, if the Greek leaders had been simply "following orders", then a more substantive form of bailout would become inevitable, and Herr Bruederle's fears that the German taxpayer may end up having to foot part of the bill would be realised. With this in mind, I really suggest that Commission members and Finance Ministers think very carefully about what they are doing before signing and sealing any definitive agreement with Greece. On the other hand, if the nettle is cleanly grasped, and the necessary changes are introduced both in Greece and in the EU's institutional structure, then maybe the most important and most enduring outcome of the current economic crisis will be a Europe which is more unified and effective than ever it was before.