In singling out the nine points that Klaus advances in support of his thesis for detailed examination, I do not do so because I find the arguments particulary bad (or even especially "noteworthy" in the negative sense). He has a point of view, and he is doingh is job, and in neither case can I fault him for this.

The reason I have decided to single Klaus out for special treatment here is because he conveniently brings together, in a clear and succinct fashion, a number of arguments which are widely accepted and used by both analysts and policy makers. Unfortunately the fact that arguments are widely held does not make them valid, or in anything other than the most trivial conventialist sense "true". Indeed it is precisely because I feel that these arguments are not well founded that I have decided to reply to them in this rather detailed way. Basically I don't buy the idea that Spain is simply suffering from a crisis of confidence, one which, in its turn, puts pressure on the government bond spread. I think Spain has a problem in the fundamentals department, and unless this problem is first accepted and then addressed the wrong (inadequate) remedies will continue to be applied, putting the Eurozone and its citizens at risk of financial catastrophe in the medium term.

Argument Number One: - Public sector debt is low and will stay low.

"Spain’s public sector debt ratio of 60.1% in 2010 is nearly one third below the euro area average. Excluding potential bank bailout costs, but also privatisation receipts, debt is expected to peak at less than 70%".

Not so! Or rather not necessarily so, since the beauty, here as always, is in the details. Certainly Spain's public debt to GDP ratio is low by European Union standards, and significantly below the EU average. But it is not the case that it is universally expected to peak below 70%. In fact the IMF (to name but one) expect Spanish government debt to GDP to hit 72.1% of GDP in 2014, rise to 74.13% in 2015, and stand at 75.94% in 2016 (according to their April 2011 World Economic Outlook forecast).

In fact, we don't yet know where Spain's debt to GDP will peak, or when, since there are too many unknowns in the equation to reach a definitive conclusion, all we do know for sure is that it continues to rise, indeed according to Bank of Spain data released last Friday, by the end of the first quarter of 2011 Spain's gross debt was up again, and stood at 63.6% of GDP.

There are many factors that could condition the size of the debt to GDP ratio, the unpaid bills on regional government books (93.6 billion euros at the end of Q4 2010), the 83 billion euros given by the government in guarantees (or 7.8% of GDP, a quantity which will only be turned into debt should the guarantees need to be honoured), the debt which is languishing on the books of public sector companies (55.7 billion euros at the end of Q4 2010), the possibility that the Spanish economy have a bout of deflation at some point, etc.

But all of these are, when all is said and done, comparatively small beer, and would simply imply, for example, under a worst case scenario that Spain's debt to GDP might peak around 95% of GDP as opposed to the IMF's 75%+ calculation, high, but not unmanageable, provided the economy returned to growth. But, as the Societe Generale commentary suggests, by far the largest downside risk in the whole picture is the size of any potential bank bailout costs. Here we are almost totally in the dark, since we know the minimum (the cost of the current FROB restructuring) but we have no real idea of the maximum, a point which was brought home recently by Barclay's Bob Diamond when he visited Spain's Prime Minister Jose Luis Rodrigo Zapatero in the Moncloa to discuss the possibility Barclay's might buy the troubled Caja de Ahorros del Mediterráneo. Most observers have little doubt that Barclay's interest was real, but the stumbling block was not the price: Bob Diamond wanted Prime Minister Zapatero to give guarantees over the potential downside for the bank assets, and of course he couldn't. I am sure Mr Zapatero has no better idea what these are than I do.

What we do know is that without being able to arrive at a conclusion on this topic, all the current debt to GDP numbers floating about don't have a lot of importance, since we can all remember only too well how Ireland's debt to GDP shot up from 25% of GDP in 2007 to an anticipated 114% in 2011. So if this risk wasn't real and a concern to market participants, then it would be hard to understand why the Spanish 10 year bond spread is currently hovering around 270 basis points over the yield on the equivalent German bund. German gross government debt is currently in the region of 80% of GDP, or some 15 percentage points above the Spanish level. So without the presence of this perceived risk market pricing would be inexplicable (which, in fairness, to Spain's economy minister Elena Salgado, she probably thinks it is).

Argument Number Two - Public sector deficit reduction is on track.

"Unlike Greece, Ireland and Portugal, the fiscal consolidation targets have been reached in 2010 and are on track in 2011, even allowing for some deficit overshoots in some of the Autonomous Regions. That means that the 3% benchmark level stands every chance of being met by 2014".

This argument, notwithstanding that this is the issue which most seems to have been worrying investors of late, may well be more or less valid. Spain's government has made great efforts to comply with what they perceive to have been investor concerns since the "about turn" in May 2010, and it is reasonable to assume that these efforts will continue, and that despite some first quarter slippage, the fiscal deficit may well come in this year at or around 6% of GDP.

Issues: the fact that public spending (and debt) increased significantly faster than they should have done in the first three months of the year (even making a positive contribution to the first quarter growth number), means that the cut backs in the second half of the year will need to be greater than anticipated (especially if growth is nearer to the Bank of Spain and IMF 0.8% estimate than to the Spanish administration's 1.3%) and these additional cuts will, of course, also further negatively impact GDP growth.

In addition there has been the recent rise of the "indignados" protest movement. With this movement gaining strength (as we have also recently seen in Greece) and becoming increasingly openly opposed to the Brussels inspired stability programme, the government's margin for manoeuvre may become increasingly restricted, and especially if unemployment continues to rise and Spain drifts back towards recession. This movement is a new factor on the Spanish scene, and its presence needs to be taken very seriously.

Argument Three - The banking sector problems are manageable.

"There is no doubt that the Spanish banking sector, particularly the savings banks (cajas), has problems. But even the most apocalyptic predictions of potential losses amount to some €200bn, which is 20% of GDP. Our analysis suggests that this would lead to a new capital requirement of some €60-70bn, equivalent to 6% of GDP".

This argument is obviously one of the most tendentious of value judgements. What is manageable here, and what isn't? Where do we begin in this minefield? To know the true level of losses to which the banking system is exposed we would need to know a number of things we evidently don't know and are possibly in principle incapable of knowing with any exactitude until the Spanish economic drama unfolds further. This is effectively the reason why Spain's Prime Minister José Luis Rodriguez Zapatero couldn't give Barclay's CEO Bob Diamond the guarantees he was looking for on his visit to the Moncloa to talk about buying the Caja de Ahorros Mediteraneo. Mr Zapatero couldn't help him, since he didn't know either.

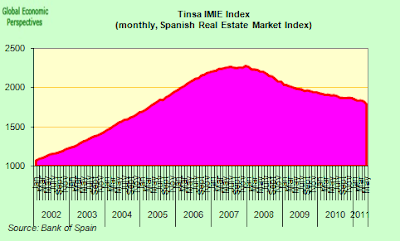

To be able to adequately answer the question we would need to know how far, and during how long Spanish property prices were likely to fall. Really this is a question to which no one has a real answer. Certainly we know that the index maintained by property valuers TINSA fell at an interannual rate of 5.88% in May, the fastest drop since December 2009, and that the market is showing all the signs of having a double dip, especially taking into account that total house sales hit a post crisis low of 24,100 in April, while new home sales fell to 11,500. In fact house prices on the TINSA reckoning have now fallen 21.5% since their December 2007 peak, and we have no real clear idea of how much further they have to fall.

We would also need to know the level at which Spain's unemployment were going to peak, and how long it will need to get back down to single digit levels. This is becuase one of the key factors which will also have a sure and certain impact on the level of bank loses is the level of unemployment, since it will influence mortgage default rates, and also serves as a proxy for many other economic indicators which also affect bank profitability. Monthly labour office signings fell back in April and May, due to the impact of seasonal industries like tourism and agriculture, but the seasonally adjusted figure continues to rise, and stood at 20.7% in April according to Eurostat data.

One think we do know is that Spain's banks still don't have normal access to the interbank market. Thus confidence among other bankers (as opposed to among politicians and policy makers, or what bankers themselves say in public) is not as high as it could be that these problems are easily manageble. In addition, every time risk aversion rises in the Eurozone pressure on Spanish banks mounts, and it is not insignificant that they have been going back to the ECB in increasing numbers since April this year.

One think we do know is that Spain's banks still don't have normal access to the interbank market. Thus confidence among other bankers (as opposed to among politicians and policy makers, or what bankers themselves say in public) is not as high as it could be that these problems are easily manageble. In addition, every time risk aversion rises in the Eurozone pressure on Spanish banks mounts, and it is not insignificant that they have been going back to the ECB in increasing numbers since April this year.

Argument Number Four - The current account is under control.

“Spain had a current account problem in 2004-2009, with a shortfall that peaked at 10% of GDP in 2007. But by 2010, the shortfall had fallen to 4.5%, and a further decline is likely as domestic demand remains weak at least until the end of 2012, and export competitiveness improves, both in manufacturing and in services/tourism”.

Unfortunately, the Spanish current account is NOT under control. The twelve month trailing deficit has reduced by around 60% from the 2008 high point, but has been stationary at around 4% of GDP for over a year now.

Two factors have accounted for this sharp drop, a fall in imports and a reduction in interest servicing costs on the external debt. Exports have returned more or less to their pre crisis high (see below), while imports dropped sharply and have not recovered their earlier level, so one part of the CA deficit improvement is due to lower consumption and lower living standards, a change which due to the way GDP is calculated (only net trade counts) is actually GDP positive, but try telling that to the “indignados” protesters. The only politically sustainable way to carry out this sort of transformation over time is via a sharp increase in the historic trend level of exports.

But it is the second component in the current account improvement which most analysts miss, and that is the change in the income account (see chart below).

The 12 month trailing income account balance has improved by roughly 40% since early 2009. The reason for this is not an improvement in Spain’s external indebtedness position (see below), since logically with an ongoing current account deficit the external position continues to deteriorate, but a decline in corporate profitability associated with the crisis, and a drop in interest servicing costs on the debt as interest rates have fallen to historic lows. The important point to grasp here is that both of these components are CYCLICAL and not STRUCTURAL. That is to say, if interest rates were to rise again to previous levels (normalise) ECB, and corporate profitability recover then the income account would automatically once more deteriorate. The good news is that this is unlikely to happen, but the bad news is that this is unlikely to happen since the Spanish economy is unlikely to recover, and the ongoing weakness in the peripheral economies (including Italy) means that the ECB is unlikely to be able to go very much further with its rate normalising policy.

The real problem is the country risk element. As the spread on Spanish sovereign debt and bank debt rises the income account will evidently deteriorate, and this is obviously one of the major risks for the Spanish economy at this point. The more country risk rises, and the more the weight of interest payments pressurises the current account the more living standards internally need to be compressed (via austerity measures) simply to keep the country afloat. Clearly at some point or another this hits political viability limits. Also, it should be noted that while net external debt is around 90% of GDP (very problematic in and of itself), gross debt is roughly double that, and if Spain country risk (and hence the cost of financing) rises, while country risk (and hence interest rates) in key emerging markets (from a Spanish point of view) continues to fall, then the structural income balance can even deteriorate, as well as the cyclical balance.

Argument Number Five - Competitiveness is not as bad as many think and improving.

"One, Germany is not the benchmark – it was clearly not competitive in 2000, owing to unification in particular. The gap to the euro area aggregate for example is less than 10%. Two, Spanish ULC were in part driven higher by ULCs in the construction sector, which has little bearing on export competitiveness. In any case, if Spain has really lost so much competitiveness it would be unlikely to export as successfully as it does: from 2005 to 2010 (annual data, nominal), Spanish exports rose every bit as much as German exports (21.0% versus 20.9%). And Spanish labor is cheap: according to Eurostat data, wage levels in Spain are 25% below the euro area average".

This issue is basically the nub of the question. If Spain's economy is not fundamentally uncompetitive then it should gradually return to sustainable growth, given enough time and a few labour and product market reforms. But if it is as uncompetitive as I, and other macroeconomists, argue (needing a price adjustment with Germany of around 20%), then not only will the growth not return, sovereign debt default 5 or 6 years down the road could become a growing possibility as the banking system creaks and strains under the weight of accumulated debt and non performing loans.

If Germany is not the benchmark for Spain, then it is hard to know who is. Evidently it should not be Italy, or any of the other low growth peripheral economies, since being as uncompetitive as they are is hardly going to help see Spain through. Perhaps France is the benchmark? But then France has a deteriorating current account position, so even France may not be a good role model for Spain, especially since the French private sector is not heaviliy indebted in the way the Spanish one is, and hence the economy is still laregly driven by domestic consumer demand, something which is now impossible in Spain - at least while the deleveraging process is taking place.

So here is the nub of the matter, and the key problem that those who tend to dismiss the macroeconomic arguments need to try to follow, since this isn't a game to see who is right and who is wrong, it is about saving the Spanish economy, and with it (if possible) the euro: THE SPANISH ECONOMY IS NOW TOTALLY EXPORT DEPENDENT FOR GROWTH.

This is why macroeconomists tend to use the German economy as a benchmark, since the German economy has successfully become an export driven one, and Spain needs to follow in Germany's footsteps. Evidently, as Klaus Baader tells us, the German economy was far from competitive in 2000, which why the German economy had to go through a hard and painful restructuring process to gain the competitiveness it needed to generate the level of exports it needed to improve the growth performance. Now Spain needs to follow in Germany's footsteps, and I don't see the point in trying to deny this.

Spain is now an export dependent economy due to both debt overhang issues and due to the economic impacts of population ageing. Spain is not returning to the pre crisis world it knew, because Spain is already too much in debt to be able to drive growth by generating even more debt, and because Spain's median age is rising in a way which is going to change the pattern of national saving and borrowing. And there is a third and "last nail in the coffin for the old way of life" kind of argument that is important here, and that is the Spanish are about to realise what either Franco Modigliano or Milton Friedman could have explained to them decades ago, and that is that a house is a place to live in, that is to say a consumption good, and is not part of some fancy new asset class of investment good which you can use to get rich easily, and speculate with. 77% of the total stock of Spanish savings is invested in property, and around 85% of the Spanish population own one or more homes, which means, as the Spanish themselves are now discovering, that as property prices go down you suddenly start to get poor in just the way you formerly got rich.

Indeed herein lies one of the key floors in the way Spanish policymakers tend to think about economic issues. We are now no longer living in the pre 1930s world were spending out of current income was the key indicator to understand economic growth, either credit or export surpluses drive modern growth, and where there is little credit, and insufficient exports, then there is little (or no) growth. In fact, with property prices falling in a way which constantly reduces the value of their stock of savings, Spanish families may well be caught in a modern paradox of thrift whereby no matter how fast they try to save out of current income they still are in a negative net wealth dynamic as property prices fall and fall.

Anyone who wishes to understand why Spain's banks have not driven prices down sharply through firesales should consider carefully how this would impact on household wealth, and saving and spending patterns.

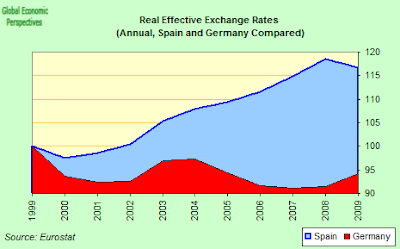

But back to the issue in hand, export dependence and Spanish competitiveness. Evidently, the first piece of evidence macroeconomists present is the comparative Reel Effective Exchange Rate data. Of course, critics of macroeconomists argue that this is almost irrelevant, but I don't see why we should shy away from presenting this data simply because some people don't like it, since in my humble opinion it certainly isn't irrelevant. Looking at the chart below it should be obvious that Spain lost price competitiveness vis-a-vis Germany systematically from 2000 to 2008.

Of course, there is another way of looking at the whole problem, and that is to look at productivity movements. Again we can see that from the start of the century till the outbreak of the crisis, German productivity improved significantly over Spanish productivity. This situation reversed somewhat during the crisis (I will come back to this below).

On the other hand, when it comes to living standards, what we find is the exact OPPOSITE, that is to say Spanish living standards improved significantly more than German ones. So in one country living standards rose, while in the other productivity rose - surely something is upside down here, isn't it. Naturally, and on aggregate, the Spanish paid themselves more than they were economically worth, and used borrowing guaranteed by their houses to do this. There is no great mystery here. But what it does mean is that Spain LOST COMPETITIVENESS. They weren't the worst along the periphery in this sense, but that is beside the point. And it doesn't matter at all here whether Spanish wages are low or high, what matters is how much you produce in each hour you work. Something Angela Merkel learnt to her cost recently when she suggested that Spanish workers should work longer hours and take less holidays (you know, that siesta feeling), only to find that the Spanish work longer hours than the Germans. Also, I have used nominal GDP per capita (and not living standards) here, because it doesn't matter how much your earnings can buy in real terms for this calculation, becuase the fact of the matter is that the Spanish worker is paid in those very same Euros as German workers are, so the direct comparison is valid. If Spain still had pessetas all that extra inflation wouldn't have mattered so much, since the country could have devalued and made the adjustment. But it can't, it is stuck with the legacy of the past, which is why I and other macroeconomists have been advocating a simulated (internal) devaluation to bring the price and wage level down by 20%, but virtually no one has been listening, since like Klaus Baader, they don't think it is necessary. They think - along with members of the current Spanish administration that talk of Spain's loss of competitiveness is exaggerated.

Another way of looking at things is via a comparison of unit labour costs. As we can see, Spain's unit labour costs rocketed when compared with Germany's during the first 8 years of this century. This is only the same thing as saying that productivity didn't rise very fast while wages did. What is interesting is that this process moderated with the onset of the crisis, and indeed Spain's unit costs fell, even as Germany's rose somewhat. Many have cheered this as an indication of a successful adjustment. But they are missing something here, and this is what is known as the compositional effect. Basically Spain's economy shed nearly three million low-paid, low-productivity workers as the construction boom unwound. The result of this was that aggregate productivity ROSE, and aggregate unit costs fell - while unemployment rose from around 8% to over 20%.

German employers, on the other hand, made great efforts to retain workers via the system known as Kurzarbeit, and as a result unit labour costs rose, and indeed productivity fell (remember the productivity chart). German industry sacrificed some of its competitiveness in the interest of social cohesiveness, and not inflating the government deficit, and unemployment continued to fall almost all the way through the crisis (see chart below). Naturally now the German economy is more or less back to its earlier capacity levels productivity is once more improving.

Now, let's go back to the international competitiveness argument. Obviously this is not the same thing as saying that each and every Spanish company (or sector) is uncompetitive, but that the economy as a whole is not sufficiently competitive, that is to say not sufficiently competitive to generate the export activity needed to return the economy to sustainable growth. There is an externally tradeable sector which is comparatively competitive, and a munch larger non tradeable sector that is completely uncompetitive. In this sense, don't look at the exports, look at the imports: Spain needs to produce domestically a lot more of what she imports, this alone would turn the trade deficit into a trade surplus, and provide employment to boot. The problem is that the sectors which produce these products have either been closed down or are not able to compete on price. Talk about the energy deficit is irrelevant here, since oil prices are what they are, and since Spain is externally dependent on energy this needs to be imported. Of course, the energy deficit can be reduced by conservation changes and alternative energy sources, but none of this alters the fact that Spain needs to produce sufficient exports to cover ALL imports, and then some more to generate a surplus to drive GDP growth.

So, and summing up, the key point about Spain's export sector is not that it is not competitive, but that it is FAR TOO SMALL for the job it now has to do. Spain's exports have returned to their pre.crisis high.

As have Germany's, but just look at the relative size of the two sectors (and this chart is goods & services, so tourism is included).

Of course, Germany's economy is a lot bigger (but not THAT much bigger), so let's look at the relative shares of Spanish GDP and exports as compared with their German equivalents. As can be seen in the chart below, Spanish GDP increase steadily as a % of German GDP in the years before the crisis (as we have seen, there was no relation between what people were being paid and productivity in Spain over these years, quite the opposite), while exports as a share of German exports actually went DOWN. Make of that what you will, but it is another interesting data point for anyone who really wants to get to the heart of Spain's current problems.

On the other hand, with exports now back near their previous peak, capacity levels must be getting strained, so Spain's export sector should be in need of increasing investment in capital goods, shouldn't it?As can be seen in the following chart, investment in machinery and equipment in Spain was rising steadily as exports rose in the pre-crisis period. Then the rate of investment fell by nearly 40%, and since that time the level HAS HARDLY MOVED.

In Germany, on the other hand, we see the same pre-crisis pattern, and then the slump, but in contrast to the Spanish case, investment took off again as exports started to pick up. Germany is increasing capacity, while Spain isn't, doesn't that tell us something about competitiveness. It is one thing to get export prices more or less right using an old capital stock, and relatively cheaper workers (under the new contracts), and quite another matter to buy new capital and start to increase export market shares.

And as always, the proof of the matter is in the eating. If things were going well, and Spanish exports really were doing as well as German ones, how come one economy is booming and the other flirting constantly with recession? Enough of misleading casuistical arguments and more facing up to reality, please!

Argument Number Six - Competitive disinflation is underway.

“Wage growth in Spain has slowed sharply, and is now running below euro-area average rates (and those of Germany)”.

Obviously it depends what you mean by competitive disinflation. As Kluas Baader says, wage growth has slowed, and wages are now rising more slowly than Germany's are (but not by that much!).

On the other hand, the general price level is once more consistently rising faster than Germany's is, and this in an economy which is hardly growing and in comparison with one which is booming. So the gains which are being made on wages are being lost in general inflation differentials.

And Spanish industrial producer prices are also consistently rising faster than German ones, which gives us the strongest argument for much deeper structural reform that I can think of.

Bottom line, as of the time of writing competitive disinflation is NOT underway.

Argument Number Seven - Much of the economic weakness reflects rebalancing.

“Weak domestic demand growth is not so much a sign that the economy is hopelessly uncompetitive, but rather reflects a necessary, and in the end healthy, rebalancing. This pertains especially to the construction sector, which must shrink from an unsustainably level. But the share of total construction investment in GDP down from a peak of 18% to 12% in just three years. Hence, most of the adjustment has already taken place”.

Weak domestic demand growth is a reflection of significant over-indebtedness, a shortage of credit (even for solvent activities) , and the weight of a massive debt overhang. Uncompetitiveness comes in, as we have seen above, when you need to get export driven growth following the collapse in domestic demand produced by the over indebtedness.

But what rebalancing is taking place here? One section of the economy, the construction one, has shrunk massively, with the result that unemployment has risen to 20.7%.

But, as seen above, investment in new sectors is NOT taking place, so, there is no re-balancing at this point (unless, again, one insists on being causuistical) , and if anything the economy is even more lop-sided, since rather than balance there is simply a huge hole letting in water, rather like a battleship which has just seen an exocet tear through it just above the waterline.

Just how unbalanced is the Spanish economy? Well look at the size of outstanding developer loans shown in the chart below, something like 320 billion euros of them. These represent houses that are either unsold, unfinished, or even as yet unstarted.

The Spanish economist Ricardo Vergés, who is a housing market expert, has calculated that Spain may have a potential excess of 2.3 million housing units. Vergés, who used to advise the now defunct Ministry of Housing on housing market statistics, arrived at this staggering number by calculating the difference between housing starts and final house sales over to reach a figure for the unsold (or as yet unbuilt) new homes (including homes still under construction or abandoned unfinished).

Subtracting registered sales since Q1 2004 of 2.45 million from housing starts since Q3 2004 of 4.77m, Vergés comes up with his figure of 2.3 million housing starts that have yet to end in sales. It is estimated that roughly 1 million of these houses have been completed, thus there may something like 1.3 million more waiting to be finished, and hence the large mass of developer loans outstanding. Naturally, to complete these houses the banks will need to provide yet more credit to developers, making it even more difficult to fund new profitable businesses even as credit in general is reined-in in a bid to meet the new (higher) core capital requirements.

To get an idea just how difficult it would be to shift all these developer loans and turn them into sales, a contrast with the existing stock of mortgages (after all the boom years) is instructive. At the present time the Spanish banking system is financing just short of 700 billion euros in mortgages. To accomodate all the latent needs of the housing sector this number would need to go up by something like another 50%, and in a period of "rebalanced" economic activity. The argument staggeringly fails to convince.

Argument Number Eight Private sector debt is high but correcting.

“Spanish household debt is high at 120% of disposable income (same as UK, lower than Netherlands, Ireland or Sweden, but above the 82% euro area average). But the deleveraging of the household sector has begun: the household savings rate soared from 10.3% of disposable income in 2007 to 17.7% in 2009 (it has since eased back to 13.0%). Credit growth has come to a complete halt”.

Firstly we need to be clear, household debt is not the sum total of all private sector debt in Spain, there is also corporate debt to think about. The combined total is something like 220% of GDP (90% for household debt and 130% for corporate debt). Some deleveraging is going on, but it should be remembered that government debt is now increasing, so the total indebtedness of the economy isn't changing much.

On the other hand, as Klaus Baader says, credit growth has come to a "complete halt". Indeed it is even contracting. In April the total stock of corporate loans was down 0.1% over a year earlier.

While the stock of household loans was down 0.1%.

Is this a good thing? Well it is and it isn't. It is positive in the sense that the private sector is timidly deleveraging, but it is also systematic of the fact that there is a strong credit crunch taking place, and that new initiatives (that could help rebalance) are finding it extremely hard to get credit. Basically the banking system isn't on the point of implosion, and it isn't going to disappear tomorrow, but it is sufficiently badly affected that it is strangling the real economy, and that is one of the main reasons a recovery isn't coming.

Argument Number Nine - Spain is not being crushed by market interest rates.

“Unlike Greece, Ireland and Portugal, Spain is not being crushed by unsustainable refinancing costs for its public sector debt”.

Well...... This is not the best moment to be asserting this Klaus! Certainly Spain's interest rates have not reached the horrific heights attained by their Eurozone neighbours, but they are also hardly rubbing shoulders with historic lows. Last week the spread of the Spanish ten year bond over the German bund equivalent hit a new Euro era high of 288 base points.

More to the point, the 10 yr yield closed on Friday at 5.68%, for the first time going above November's previous high of 5.67%. Obviously psychological thresholds now loom at 300 bps on the spread and 6% on the yield, and if the market breaks resistance on these there is a danger that they could move higher quite sharply, especially if the Greek situation deteriorates in any way, or if the ECB surprises markets by not moving rates in early July. Not exactly the best of environments for a critical Bankia IPO.

As I said above, since April the Spanish banks have been returning to the ECB funding fold in increasing numbers, for the first time since Spain managed to "decouple" after the Eurozone crisis of May/June 2010. Again, a sign that the decoupling may now not be holding.

This post first appeared on my Roubini Global Econmonitor Blog "Don't Shoot The Messenger".