Sharp Reduction In The Rate Of Global Manufacturing Contraction In April

The Spanish economy, like any other, is to some extent sensitive to movements elsewhere in the global economy, and it is not unimportant to note that the JPMorgan Global Manufacturing Purchasing Managers’ Index (PMI) - which is based on surveys covering over 7,500 purchasing executives in 26 countries which between them account for an estimated 83% of global manufacturing output - posted a reading of 41.8 in April, thus coming in well below the critical 50 neutral mark separating expansion from contraction for the 11th successive month. In rising from the 37.3 level shown in March, the PMI managed to post its largest month-on-month improvement in the series history attaining in the process a seven-month high. The sharpest point in the contraction was last December, when the indicator hit the all time series low of 33.7.

The picture painted by the index was, however, a mixed one, and emerging economies generally fared rather better than developed countries. This was especially the case in China and India, the only two countries covered by the survey to actually to report increases either for output or new orders. Rates of contraction in output eased to a seven-month low in the United States and to the weakest since last October in the euro area. And please note, output and new orders in Spain and Japan continued to fall significantly faster than the global average, although even in these cases the contraction rate improved markedly over earlier rock bottom lows.

Spain

The rate of decline in Spanish manufacturing slowed again in April (for the fourth consecutive month), and April's PMI rose to 34.6 from 32.9 in March. This is now significantly up from December's record low of 28.5, but the contraction remained very strong, and this was still one of the lowest readings globally.

The pace of deterioration eased in output, new orders and employment, though stocks of purchases and finished goods hit series lows. Survey responses suggested the rate of decline in the badly hit jobs market had eased slightly from earlier falls, but the reading still remained well below growth levels, and Spain's economy continues to bleed jobs, adding to levels of employment which the latest labour force survey data suggests has now risen above 4 million (or 17.3% of the economically active population). Staffing levels have declined every month since September 2007, according to survey records.

The PMI - which is simply a survey indicator - backs up the findings of Spain's own National Institute of Statistics, who announced last week that the industrial production in March declined by a calendar adjusted 24.7% year-over-year, after falling 22.5% in February. The seasonally adjusted index gives a dramatic and clear indication of the long march into decline which currently characterises Spanish industry.

The seasonally adjusted index gives a dramatic and clear indication of the long march into decline which currently characterises Spanish industry.

Services Also Contracts More Slowly

The contraction in global services activity also seems to be easing up, following the pattern displayed by the manufacturing sector, and the JPMorgan Global Services Business Activity Index rose for the second month running in April, registering at 43.8 its highest level since last September. It is important to keep clearly in mind, however, that the headline index remained well below the critical dividing line of 50 which separates growth from contraction, and thus we are still firmly within global recession territory. So stabilistation in the contraction is not the same thing as recovery.

Spain

Spanish service sector activity continued to decline in April although as elsewhere the rate was much slower than in previous months. The headline activity index stood at 42.5, still well below the critical 50 level indicating growth, but way above 34.1 in March and November's record low of 28.2. April's figure was in fact the highest recorded since May 2008 but nevertheless marked the 16th consecutive month of contraction as the deep recession weighed on new orders and jobs. According to Andrew Harker ,economist at Markit Economics, "Jobs continued to be lost at a fast pace, indicating that the labour market remains a key source of weakness."

The survey showed staffing levels declined in April for the 14th month running as service providers cut jobs due to lower activity and to keep costs down. Hotel and restaurant firms were the hardest hit. However despite Spain's deep and ongoing economic crisis, April's survey was marked by confidence levels not seen in 15 months. Many of those surveyed by Markit said they believed the crisis would end within a year, with two-fifths of panellists expecting activity to be higher in 12 months and just 22 percent forecasting lower activity. However, companies remained relatively cautious about short term economic prospects.

The service sector thus is showing a significantly sharper rebound from the record declines of the last few months than is to be seen in the manufacturing sector, which continued to contract at a rapid pace in April.

Prices continue to fall, and services output prices registered the third-fastest decline in the survey's history, second only to February and March this year, with those surveyed citing increased competition for new business and pressure from clients. Service providers also reported falls in input costs due to reduced labour costs and lower prices from suppliers, but, according to Markit, the decrease here was less marked than that for output prices.

House Sales Continue To Fall (More Slowly)

Spanish house sales fell again in March, but as the desperate seekers of green shoots are so eager to point out, at the slowest pace in the last 11 months, according to data from the National Statistics Institute. Home sales fell 24.3 percent to 34,895 in March in what for what was the 13th straight month of decline, but the level was below the rates of 37.5 percent in February and 38.6 percent in January. Of course, once contractions have been running for more than twelve months you start to get what are known in the trade as "base effects" (since this years figure is simply down from an already reduced number the year before), and it is possibly more interesting to follow the actual number of sales, which you can see on a three monthly average basis (to iron out some of the seasonal quirks in the data - an old economists "quick'n dirty" trick) in the chart below. It's not too clear that we can talk about any "easing" in the recession looking at this chart. Even with monthly sales running 10,000 or so higher than the present level, the construction industry would still be in a huge slump.

In fact some increase in sales is only to be expected as banks repossess homes from houseowners and property developers due to the soaring rate of debt defaults, only then to put them on the market at ever lower prices. And again, the March housing results were influenced by the statistical impact of a sharp, 39 percent fall in March 2008 sales (the base effect) and the fact Easter fell in March last year. Nonetheless the number of sales was slightly up on February.

So what we are talking about is less deterioration, not any visible improvement.

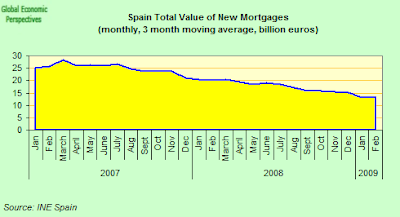

While The Number Of Mortgages Goes On Dropping

The average value of the mortgages signed in February was down by 12.1% year on year and reached 148,798 euros The number of mortgages that change conditions increases 24.6%, while registered cancellations decrease 29.7% During the month of February, the average amount per mortgage constituted stood at 148,798 euros, 12.1% less than for the same month the previous year, and 1.2% lower than that recorded in January 2009. The average value of housing mortgages was 123,643 euros, down 17.0% year on year, but up 1.3% on January.

The number of new mortgages was down 28.5% year on year.

While the total value of mortgages issued was down 37.2%.

While the total value of mortgages issued was down 37.2%.

Bottom Line: No End In Sight (Far From It)

So basically, while it is true to say that we undoubtedly saw a moderation in a number of indicators in April, this is still a far cry from any kind of green (or even Brussels) sprout, or anything vaguely resembling one. And the key to the story is to go back to where we started - the credit crunch. It may all seem like a long time ago now (like in August 2007) but all this started after many years of exaggerated bank lending to Spanish households and corporates sent property prices, and with them relative wages and prices, way out of line with the true net worth of the underlying economy and labour force. It is like Spain suddenly developed a version of "twisted vertebrate illness". And now all these distortions need to correct themselves. And since for two years now the Spanish government and people have vigourously failed to face up to the underlying cause of the problem, there is little alternative at this late stage in the game to a pretty violent correction.

The heart of it all has been excessive bank lending, lending which basically came from the exterior (since Spain was low on domestically generated saving, everyone wanted to "invest" in property) and basically made possible and funded a large external deficit (which is now also closing, again painfully, since exports are not rising, and all the work will be done by falling imports and living standards). Basically to get 4% annual GDP growth Spain's corporates and households were increasing borrowing at a rate of around 20% per annum. The credit crunch has put a stop to all that, and year on year household borrowing is gradually dropping to zero (before going negative, see chart below).

In fact total household borrowing is now below the level of June 2008, so the rate will turn negative in June at the latest.

And of course the same thing is happening with housing loans, and total mortgages outstanding have now dropped for the last four months.

The rate of decline in lending to corporates has been slower (all those non performing loans building up, since more debt and less revenue and profit ultimately don't add up), but the key moment will come when the banks can no longer hang on to all the debt and they have to start to let things go in earnest.

The rate of decline in lending to corporates has been slower (all those non performing loans building up, since more debt and less revenue and profit ultimately don't add up), but the key moment will come when the banks can no longer hang on to all the debt and they have to start to let things go in earnest.

In fact, total Spanish debt reached something like 250% of GDP before this burst (with a 20% y-o-y growth rate in loans and a 10% of GDP annual current account deficit) and this level is evidently completely not sustainable. During this correction the net indebtedness of the Spanish nation will have to drop significantly as a proportion of GDP. Ironically, as GDP contracts, debt has still been rising, as government has simply stepped in to take on the burden with more or more state borrowing. Ultimately this won't work. The EU commission estimate that the Spanish deficit will hit around 9% of GDP this year, and my guess is that this is the last year where such abuse of borrowing will be tolerated. I say abuse, since while no one would argue Spain doesn't need to run deficits at this point, there is simply no sense at all in running them without a plan, simply to buy time, and hope. This in Spanish is called a "huida hacia adelante", and this is exactly what Spain's policy has been about - running ever faster to try to catch up with your own shadow.

So as I say, debt to GDP is most probably rising even now, but it is obviously going to have to come substantially down, which is why I insist on saying, this correction has hardly even gotten underway yet.

4 comments:

Just one specification: it's "huida hacia adelante".

Hi Focio,

I've corrected. Thanks, and thanks for reading me so carefully (this comes almost in the last line :) ).

Edward

Edward,

I just came across your blogs on Spain's economy. Marvelous--thank-you for taking the time to post.

In the May 11th article you mention that Spain's "informal" economy runs about 20%. I'm curious how you came up with that number. As an ex-pat living in Spain I have seen the windows slam down hard on black money jobs in the last year and I wonder if that number is changing at all.

Also do you see Spain becoming a heavier recipient of EU funds once again? Spain was suppose to become a contributer but given the current crisis it's hard for me to guess who will be receiving.

Again, thank-you.

Tim

Hi Tim,

"In the May 11th article you mention that Spain's "informal" economy runs about 20%. I'm curious how you came up with that number."

Well basically it comes from an estimate made by the INE some years ago when there was an upward revision in the GDP numbers. But this is a very rough and ready, rule of thumb, number.

There are a number of methodologies out there that try to estimate informal sectors (electricity use, eg), but I don't know if any of them are very satisfactory.

So really it's hard to say whether the proportion is rising or falling, but I suspect that now, as the contraction bites more and more people will be moving back into the informal sector to save costs, etc.

But...

"As an ex-pat living in Spain I have seen the windows slam down hard on black money jobs in the last year"

If this anecdotal evidence is replicated, it would suggest the opposite. And of course be consistent with the Labour Force Survey data on job loss, since this would be picking up impacts on the informal side, due to the anonymous, survey based, methodology.

"Also do you see Spain becoming a heavier recipient of EU funds once again?"

Definitely, but not from the old structural funds source. Basically, monetary and fiscal policy has entered a "new tools" era following the arrival of zero interest rates and the global crisis, and Spain and Ireland will have to be major recipients if they are to get out of the messs they are in - which is, after all, partly the result of earlier ECB policy decisions.

We saw the first sign last Thursday when they decided to buy covered bonds. This is all complicated, and I am about to post on it, so you will see better when I have finished the next post.

And the other source will be the commission via the issuing of EU Bonds. Basically Google "EU Bonds" and you will find my AFOE post on the topic if you want to learn more.

Basically the ECB will work the monetary side, and the Commission the fiscal side, but the two are inevitably going to get blurred as we move forward.

Officially the EU is not in favour of EU bonds "yet", but they will come. A Latvian journalist friend of mine recently interviewed Almunia, and specifically raised this issue. She sent me the full text, and I reproduce the relevant part below. As you see, he doesn't say yes, and he doesn't say no. Typical ECB and EU Commission "speak", and my feeling is they will come, to finance the Irish "bad bank", and the Spanish one when we get it.

******************************

Question: Euro has proved to be an effective shield protecting eurozone economies from the shocks of the crisis. But some argue that the crisis has highlighted the fact that European financial markets are fragmented and that there is a need for a single market for government bonds. George Soros argues that “a eurozone bond market would bring immediate benefits in addition to correcting a structural deficiency”. It would lend credence to the rescue of the banking system and allow additional support for the more vulnerable EU members. Do you agree?

Joaquin Almunia: As the Commission itself pointed out in the report on 10 years of Economic and Monetary Union published in May 2008, the euro-denominated bond market indeed remains very fragmented on the supply side. The issue of European bond issuance has been discussed on and off for several years now and even more frequently since the financial crisis started. I think this is something we should consider in future to promote greater financial market integration and more efficient European government bond markets. But I also think this is likely to be a gradual process. Better coordination of national government bond issuance, for example, could be a first and necessary step.

Post a Comment